What is Fractional CFO and the Benefits of Hiring One

In today’s rapidly evolving business landscape, demand for fractional leaders is rising, with a 170% increase since 2022. Of all interim levels requested, 56% are at C-suite level, with a doubling demand for fractional CFOs.

For many companies, when the in-house team lacks the necessary financial expertise, hiring a full-time, permanent CFO might not be a cost-effective or timely solution. In such cases, fractional CFOs, also called interim CFOs provide an ideal alternative. In the first quarter of 2024, the number of finance leaders exiting the C-suite surged, with the tech sector experiencing the highest CFO turnover since 2022.

However, hiring an interim CFO can be challenging, and making the right choice has a crucial impact on business performance. This guide offers a comprehensive analysis of:

- The role of Interim CFOs in businesses

- The benefits of hiring an Interim CFO

- Case Study Interim CFO: Financial Excellence for Healthcare Scale-up

The Importance of Fractional CFOs for Organizations

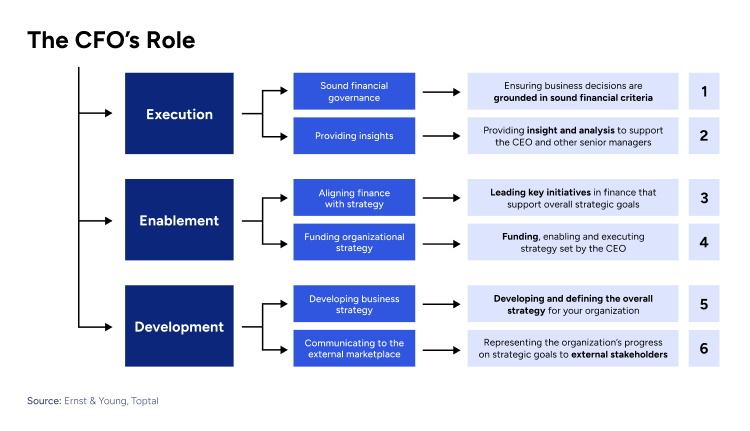

The Role of Modern CFOs

Fractional CFOs are proven finance executives who bring extensive expertise to a company on a project basis. CFOs collaborate closely with the CEO in overseeing all financial activities, including budgeting, forecasting, and financial planning.

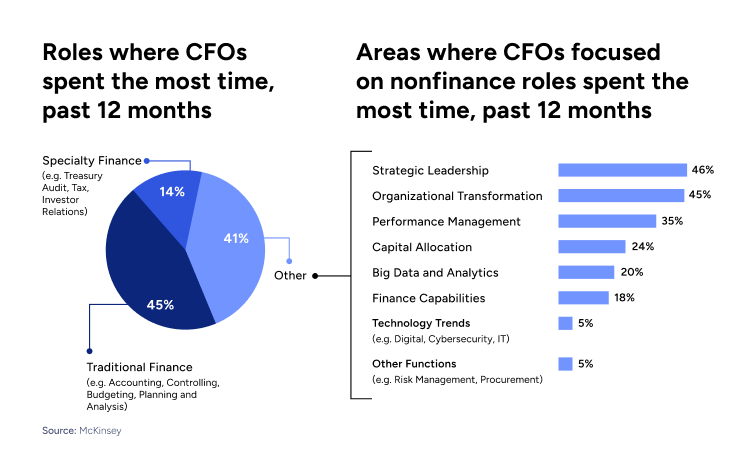

However, today’s CFO roles are much more than finance. As per McKinsey, more than half of CFOs report that their responsibilities include risk management, regulatory compliance, and overseeing M&A transactions. Additionally, 38% are also in charge of IT, with responsibilities including managing cybersecurity and digitization.

Moreover, about 40% of modern CFOs report that their responsibilities extend also to strategic leadership, organizational transformation, and performance management. 22% of them report that the area where they created the most value is strategic leadership.

Thus, there is a growing demand for “Strategic CFOs” rather than just “Functional CFOs”, limited to monitoring cash flow and financial activities, serving as controllers and accounting experts. As reported by Accenture, the majority of modern CFOs spend most of their time transforming and optimizing business operations, with a strong focus on boosting revenue and profit growth.

This new aspect of the CFO’s role demands highly specialized and qualified professionals, who can build strong financial processes and teams, collaborate on frontline strategies, and oversee critical changes like turnarounds or management reorganizations. However, not every company needs or can afford a full-time CFO with such skills, despite the strategic benefits.

This is where Fractional CFOs come in. Just like full-time CFOs, Fractional CFOs provide invaluable expertise but with added flexibility and cost benefits. They offer specialized expertise for various projects, covering both financial and strategic needs, making them a perfect fit for companies that require CFO capabilities on a project basis. When fractional CFO expertise is needed, fractional talent becomes the ideal solution.

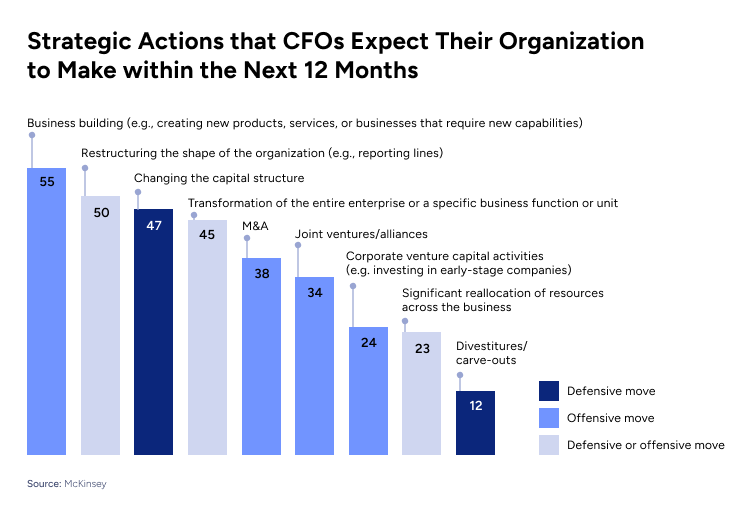

A New Priority for CFOs: Balancing Defensive and Growth-Oriented Strategies

As anticipated, CFOs were primarily seen as financial stewards, focused on maintaining the company’s financial health through budgeting, accounting, and reporting. With increased economic volatility, technological advancements, and competitive pressures, their role is profoundly changing.

As revealed in a 2023 survey by McKinsey, 55% of CFOs stated that long-term planning and resource allocation is becoming a top priority for finance, both for defensive and offensive measures. When asked about the strategic actions they expect to take in the next 12 months, there is a notable shift towards increased growth and agility, with 55% of CFOs answering business building and 50% answering restructuring.

Moreover, 47% answered to focus on changing the capital structure of the company, and 45% on transforming specific divisions of the business. In today’s environment, it’s not enough to focus solely on expansion; CFOs must also implement defensive strategies to protect against economic uncertainties and market fluctuations. Thus, CFOs must find a delicate balance between driving growth and safeguarding the company’s stability.

However, not every company needs or can afford a full-time CFO with such skills. This is where Fractional CFOs come in. Just like full-time CFOs, Fractional CFOs provide invaluable expertise on both financial and strategic needs, making them a perfect fit for companies that require CFO capabilities with added flexibility and cost benefits. When expertise on a project basis is needed, fractional talent becomes the ideal solution.

When to Hire a Fractional CFO

Hiring a Fractional CFO offers the flexibility and time required to strategize for an organization’s future goals and objectives. They can provide invaluable expertise and make a positive impact in a short period, ready to take ownership of complex financial projects. Here are common reasons for engaging with a Fractional CFO:

Manage Complex Transformations and Transactions

Changes in corporate ownership or corporate restructuring often cause a sudden departure of previous CFOs or a change in senior management. Hiring Fractional CFOs can bridge this resource gap, preventing a backlog of critical projects.

During corporate restructuring, Fractional CFOs can streamline operations, reduce costs, and enhance financial performance. Moreover, in ownership changes, they usually bring expertise in handling financial due diligence, valuation, transaction structuring, and post-transaction integration. Their ability to quickly adapt, manage risks, and optimize costs ensures that these complex processes are executed effectively, helping organizations maintain financial stability.

Fractional CFOs can help organizations manage strategic events such as a fundraising round, an acquisition, a merger, or an IPO. A financial expert can help navigate the process, ensuring the company’s financial statements meet the due diligence and compliance requirements of the investor or acquirer. They help in building financial valuation models and understand the diligence requirements of all parties involved. Moreover, they help pitch to investors and manage relationships with the banks involved.

Risk Management and Mitigation

For strategic Fractional CFOs, risk management involves more than traditional planning methods. In the post-pandemic world, new types of risks have emerged, such as global supply chain risks, which can significantly impact operations and profitability. Relying solely on historical data for predicting such disruptions and developing contingency plans is insufficient.

Hiring a Fractional CFO with deep risk management experience is crucial for real-time data analysis, scenario planning, and proactive risk identification. This involves monitoring global shipping trends, assessing geopolitical risks, and evaluating supplier stability to anticipate supply chain issues such as delays and bottlenecks.

Scenario analysis has become a prominent framework in this context. It simulates the financial impact of various events and uses advanced statistical methods to evaluate how a company's financial operating data responds to these potential risks. This approach leads to more comprehensive contingency planning, resulting in more resilient and adaptable responses to unforeseen events, focusing on strategic opportunities rather than crisis management.

Growth Projects

The need for CFO depends on the company’s size and growth speed. At earlier stages of growth, finance functions are limited to accounting and financial planning, managed by bookkeepers and controllers. Although a CFO might not be essential at these stages, 69% of startups reported little confidence in their financial decision-making. Thus, a CFO can be valuable even in the early stages, especially during takeovers or restructuring.

However, Fractional CFOs are most effective at the third stage of company growth, often during Series B funding rounds. When the revenue size and complexity overwhelm the existing finance team, a Fractional CFO can effectively address key issues and anticipate future needs. At this stage, companies are not complex enough or do not have enough budget to justify a full-time CFO. Thus, a Fractional CFO is a more cost-effective solution for their needs.

Digital Transformation and Upgrading Operations

Digital transformation of operations is a crucial aspect of the Fractional CFO’s role. The rise of software as a service (SaaS) and cloud services has significantly lowered the cost and complexity of integrating robust accounting systems across an organization. Strategic CFOs do not limit themselves to guaranteeing all employees are fully onboarded but seek opportunities to dive deeper into the data, uncovering actionable insights for the organization.

Moreover, a Fractional CFO can also be hired to drive back-office automation. Automation can aid the finance departments within tight timetables: monthly closes, urgent analysis requests, and the crunch period around mergers and acquisitions. If the finance team of a company is overloaded by routine reporting processes, replacing them with automated digital tools could increase financial efficiency.

The Benefits of Hiring a Fractional CFO

Cost savings. In Germany, in the mid-market, where the majority of CFOs are employed, the average annual pay of a CFO is approximately €140.000. Considering also benefits, payrolls, office spaces, and more, the cost for the company generally extends up to €250.000 annually. On the other hand, a fractional CFO is employed only for the specific duration of a given project. Although the hourly rate might be higher (up to €2000 per day in the case of very experienced profiles), many of the key benefits of a full-time CFO can be achieved through a part-time arrangement, resulting in a significantly lower overall annual cost.

Trust. While hiring Fractional CFOs, companies can access qualified profiles that always meet expectations. In fact, more than 20% of Fractional CFOs are eventually promoted to full-time CFO positions. This transition underscores their effectiveness and the high level of trust companies place in their Fractional CFOs' capabilities

Fast Access. When companies hire fractional CFOs, they can quickly respond to their resource gaps within a few days. For instance, Consultport ensures clients are matched with the right fractional manager or expert within 48 hours.

Expertise. Talent outsourcing opens plenty of opportunities companies of any size would not have internally. Additionally, the number of Fractional CFOs has surged, with a 103% increase since last year. Consulting platforms such as Consultport are driving this growth, providing access to top-tier expertise.

Case Study Fractional CFO: Financial Excellence for Healthcare Scale-up

The Challenge

The client, a healthcare scale-up providing medical software, faced significant financial challenges. The client struggled to maintain a healthy cash flow and lacked standardized financial reporting. This made it difficult for the leadership team to gain insights, identify revenue drivers, and capitalize on profit opportunities. The lack of financial transparency also negatively impacted investor relations.

Role of Consultport

Consultport quickly responded by proposing two strong candidates within 24 hours. After interviewing both candidates, the client selected an ex-CFO with 10 years of experience working in Berlin-based tech and med-tech scale-ups and developing investor reports. The Fractional CFO started working with the client team 72 hours after the initial request.

Project Requirements

The main requirements of the client for the project were:

- Improve cash flows

- Standardize financial reporting

- Enhance financial transparency for better investor relations

- Align financial strategies with growth plans and R&D goals

- Build a robust financial infrastructure

Approach

Strategic Alignment

The Fractional CFO conducted a thorough inspection of financial statements, expense patterns, and cash flow dynamics to understand the past performance and current financial health of the scale-up. By collaborating closely with other C-suite members, the Fractional CFO ensured that financial strategies were aligned with the company’s growth plans and R&D goals.

Building Financial Infrastructure

The Fractional CFO focused on developing a comprehensive budgeting process with clear guidelines and performance measures. Additionally, a financial reporting framework was designed and implemented, including the development of crucial finance KPIs and investor-friendly financial reports.

Findings

The Fractional CFO discovered several critical issues hindering the client's financial operations:

- Absence of Standardized Financial Reporting Systems: This made it difficult for the leadership to access reliable insights, hindering their ability to identify key revenue drivers and act on profit opportunities.

- Lack of Transparency: This strained investor relations, as stakeholders were unable to obtain a clear picture of the company's financial health.

- Inefficient Cash Flow Management: Significant fluctuations in cash flow threatened the company’s ability to fund growth initiatives.

- Outdated Financial Processes: These were misaligned with the company’s rapid expansion goals, necessitating an overhaul to support scalability and efficiency.

Results

Increased Financial Agility

The new dynamic budgeting approach improved the available working capital, empowering the client to confidently invest in growth initiatives. The financial KPIs developed by the CFO enabled ongoing monitoring of financial performance and identification of revenue drivers. The investor reports provided a clear overview of the company's financials and growth prospects, offering improved strategic alignment and financial agility. This led to:

- Cash Flow Improvement: 5% increase in available working capital

- Financial Reporting: Implementation of standardized financial reporting processes

- Investor Relations: Enhanced transparency and improved investor confidence

- Budget Adherence: Development of a dynamic budgeting process with clear performance measures

- Revenue Monitoring: Identification and tracking of key revenue drivers

Conclusion

Fractional CFOs provide vital financial leadership and expertise that can address immediate challenges and drive significant improvements in financial performance. They offer cost-effective solutions, quick deployment, and the ability to manage complex financial projects. These advantages make them an asset for organizations undergoing growth, transformation, or preparation for significant events.

By enhancing cash flow, standardizing financial reporting, improving transparency, and aligning financial strategies with organizational goals, Fractional CFOs set the stage for sustainable growth and long-term success. As demonstrated in the case study, Consultport’s CFO impact can be immediate and transformative, proving that hiring them can be a strategic investment for any business facing financial uncertainties or aiming for growth.

Wolfgang is a finance manager specialized in improving finance department’s performance and processes in the role of interim finance manager. He worked in the Automotive and Technology sectors, and has led multiple projects to streamline financial operations. Wolfgang enjoys implementing automation tools, such as robotic process automation (RPA) to further increase process efficiency and accuracy in the finance departments.

on a weekly basis.