When to Hire a Chief Restructuring Officer

Maintaining financial stability is a challenge for a growing number of companies. Taking the US as an example, in 2023 bankruptcies under Chapter 11, a legal process that allows businesses to restructure their debts while continuing operations, increased by 68%, signaling the need for immediate solutions.

Temporary measures like cost-cutting and cash injections can help businesses endure, but these efforts will not sustain companies in the long run. As a result, the demand for specialized restructuring leadership continues to grow.

This is where Chief Restructuring Officers (CRO) come into action. Unlike CEOs, who focus on long-term growth and strategy, CROs are experts in managing crises and turning around distressed companies.

In this article, we’ll explain why companies should consider hiring a CRO when facing financial difficulties and how a CRO can quickly stabilize operations and restore business health, exploring:

- Key situations where a CRO is the right choice.

- The unique advantages a CRO brings.

- How a CRO can provide faster and more effective turnaround strategies.

- A practical case study of how Interim CROs handle problems.

Understanding the Differences: CEO and CRO

A CEO is responsible for setting a company's long-term strategic direction. Their role includes overseeing growth initiatives, market expansion, and shaping corporate culture. However, CEOs might not be crisis specialists. Although some have turnaround experience, their focus tends to be broader, aiming for sustained company growth and shareholder value rather than immediate crisis resolution.

To ensure a successful engagement, the board or the company owners might decide that external expertise is in everyone’s best interest. In these cases, Chief Restructuring Officers (CRO) might be the right solution. CROs are specialists in corporate restructuring and crisis management. Their mandate is rather short-term, and they focus exclusively on stabilizing the company. A CRO handles complex restructuring challenges, such as managing liquidity crises, renegotiating with creditors, cutting costs, and optimizing operations.

Thus, the CRO’s goal is to return the company to financial health, often within a few months or years, after which they exit the business once their task is complete. Let’s explore it in more detail.

Who is a Chief Restructuring Officer?

Historically, Chief Restructuring Officers emerged from accounting firms as insolvency practitioners or advisors to lenders conducting independent company reviews. Today, a CRO may also come from the corporate sector, such as a CEO who led a successful turnaround or a CFO with financial restructuring experience.

The CRO role is often interim. If restructuring programs are implemented quickly, the assignment may last a year or, at most, up to three years if it involves an operational transformation. Once a CRO completes a balance-sheet restructuring or transformation, they typically move on to their next assignment.

Successful CROs are skilled people managers who balance challenging and supporting teams, motivating change, holding people accountable, and rebuilding trust with stakeholders with differing perspectives and objectives. Another essential trait of CROs is their ability to communicate the restructuring plan to all key parties: the board, management, employees, secured lenders, shareholders, the pension regulator, the press, and other stakeholders.

In summary, a CRO must be highly analytical, a strong negotiator, an empathetic leader, and resilient—capable of deflecting criticism and managing emotions. A great CRO also has the gift of connecting with people.

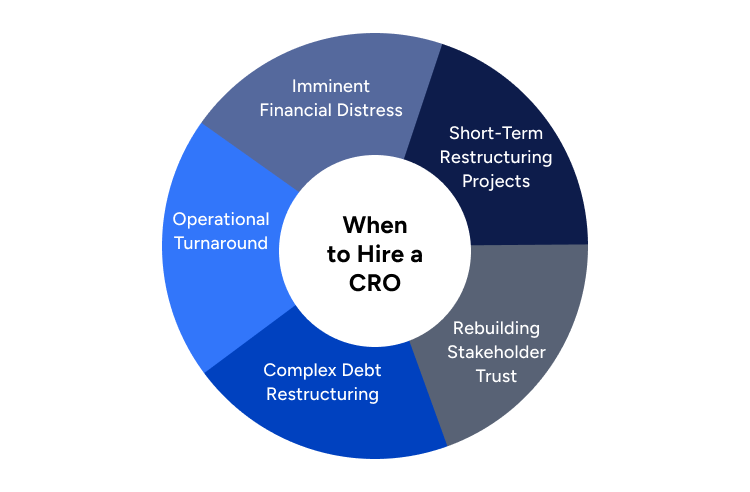

When to Hire a Chief Restructuring Officer

Imminent Financial Distress

A CRO should be hired when a company is facing severe financial distress or nearing insolvency. When liquidity is drying up, and there’s a risk of covenant breaches or missed loan repayments, a CRO’s ability to negotiate with creditors and manage cash flow becomes critical.

According to McKinsey, companies typically signal the need for a CRO when external events—such as an economic downturn or failed acquisition—lead to balance sheet fragility. Moreover, crisis scenarios often lead to high executive turnover and lower tenures, as many CEOs struggle to maintain their roles long-term due to the challenges of such volatile environments.

This indicates that most CEOs struggle to lead through crisis-driven operational or financial challenges. This is why CROs can be hired to complement CEOs to navigate such environments.

Complex Debt Restructuring

CROs are experts in dealing with overleveraged companies. If a business has unsustainable debt levels, a CRO is essential to restructure the balance sheet efficiently. They use financial tools such as “amend and extend” changes to loans for debt-for-equity swaps, debt or equity injections, forbearance agreements, and debt extensions to stabilize the business.

These strategies require a deep understanding of financial markets and restructuring options—skills that are not generally within a CEO’s scope. Also here, CROs can complement a CEO, who is experienced in managing operations and growth, but often lacks the technical knowledge needed to restructure corporate debt efficiently. Moreover, a CRO will always be on top of changes in the legal environment, knowing all the alternative schemes to compromise particular lenders in certain situations.

Short-Term Restructuring Projects

If a company requires immediate action to prevent collapse, a CRO is the best option. CROs work on a war footing, focusing on preserving cash flow, reducing costs, and avoiding immediate risks such as insolvency or asset liquidation. CROs take charge of operational and financial decisions with urgency, typically under timelines as short as 12 to 24 months.

For example, Alvarez and Marsal report that CRO-led restructurings frequently achieve turnaround results within 11 to 18 months, whereas CEO-led turnarounds can take up to 26 months or more. The time saved in hiring a CRO is often critical in crises where cash burn is high.

Operational Turnaround

In cases where operational inefficiencies are causing financial distress, a CRO can implement quick fixes to stabilize the business. CROs focus on process improvements, cost optimization, and the divestiture of non-core assets.

For instance, in a failed merger or acquisition scenario, a CRO can assess the operational synergies (or lack thereof) and make necessary adjustments, such as divesting unprofitable divisions or renegotiating supplier contracts.

A CRO’s role includes both financial restructuring and operational improvements. McKinsey notes that the CRO's ability to create operational efficiencies is especially valuable when internal management is overwhelmed by the scope of the problems.

Rebuilding Stakeholder Trust

Stakeholders’ confidence is frequently eroded when a company is near to collapse. A CRO acts as a neutral party, helping to rebuild trust with creditors, suppliers, and investors. Their role is crucial in negotiating new terms with lenders or securing additional funding to avoid bankruptcy.

Because CROs are viewed as impartial, their decisions are often seen as objective and unbiased, which is vital in securing stakeholder buy-in during a restructuring. This makes a CRO a better fit when the goal is to rebuild trust quickly and navigate delicate negotiations.

The Advantages of Hiring a Chief Restructuring Officer

Early Problem Identification

Chief Restructuring Officers (CROs) bring an objective approach to diagnosing systemic problems. Unlike CEOs, who may give priority to more strategic priorities, CROs identify underlying issues early, preventing costly delays that can jeopardize recovery efforts. Their experience helps manage areas like accounts payable and inventory mismanagement.

Unbiased Perspective

A CRO carries no pre-existing biases or attachments. With no commitment to existing processes or staff, they introduce a fresh, objective viewpoint. This independence allows them to make unbiased decisions necessary for the restructuring process without protecting entrenched interests.

Credibility with Creditors

Experienced CROs have established relationships and credibility with lenders and creditors. Their expertise in analyzing potential bankruptcy scenarios enables them to negotiate effectively. They often guide companies through restructuring processes outside of bankruptcy, presenting more favorable outcomes for all stakeholders.

Cross-Industry Expertise

While CEOs frequently bring industry-specific experience, CROs introduce solutions by borrowing best practices from a wide array of industries. Their ability to apply innovative strategies, like sourcing from unrelated sectors, are effective to resolve niche operational issues.

Certified Expertise

The majority of CROs hold the Certified Turnaround Professional (CTP) certification, which requires a minimum of five years of experience and rigorous training. This specialized knowledge in crisis management, combined with ongoing education, equips them with tools that standard MBA programs do not provide, ensuring companies receive highly competent leadership during restructuring.

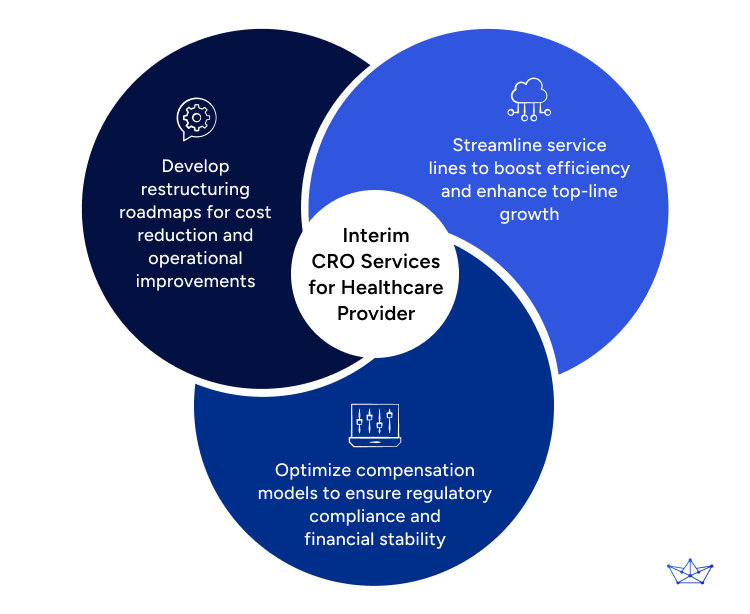

Case Study: Interim Chief Restructuring Officer for Healthcare Provider

A PE-backed healthcare service provider in southern Germany faced the challenge of restructuring multiple locations to achieve cost efficiency, top-line growth, and significant improvements in bottom-line profitability. The project required a strategic expert with experience in the healthcare industry to streamline operations while complying with strict pricing and compensation models in the DACH region.

Consultport was engaged to identify an Interim Chief Restructuring Officer (CRO) with a proven track record in restructuring projects. Consultport responded swiftly, proposing 3 candidates within 48 hours. The selected CRO brought 8 years of experience in the healthcare sector and had previously overseen large-scale restructuring programs.

Upon joining, the CRO immediately conducted a detailed financial and operational analysis across all locations, identifying inefficiencies in cost management and revenue streams. The strategy included reorganizing service lines, reducing non-essential costs, and optimizing compensation models to ensure compliance with local regulations.

In addition, the CRO developed tailored restructuring roadmaps for each location, ensuring that the specific needs of each facility were addressed without compromising the overall goal of cost reduction and improved service delivery.

The restructuring resulted in notable improvements: operational costs were reduced significantly, while the provider saw an uptick in top-line growth due to enhanced service efficiency. This comprehensive approach ensured the company’s financial recovery and positioned it for sustainable growth in the highly regulated healthcare market.

Conclusion

A Chief Restructuring Officer (CRO) brings specialized crisis management and restructuring expertise essential during times of financial distress. Their ability to act objectively, while managing both operational and financial challenges, makes them an ideal choice to help CEOs when immediate action is needed.

CROs are particularly valuable for short-term, high-pressure restructuring projects, where their experience in managing liquidity crises, negotiating with creditors, and optimizing costs can stabilize a company and pave the way for long-term growth.

In particular, engaging an interim CRO provides the flexibility to address immediate issues without the long-term commitment required for hiring a new full time position, making it a strategic solution in times of corporate distress.

Want to know more? Find a Consultant

on a weekly basis.