Private Equity Buyout Strategies Demystified

Share this article

2023 was a tough year for the global private equity fundraising sector. It shrank 11.5% year over year by aggregate value last year, the lowest total since 2017, according to Preqin data.

However, despite many headwinds and macro uncertainty, private equity was still an active player in the M&A markets. Private equity accounted for 25% of aggregate Mergers and Acquisitions (M&A) activity last year, according to EY. In this blog post, Consultport takes you through main types of private equity strategies that firms employ. We also explore how firms seize lucrative opportunities through effective private equity buyout strategies.

However, despite many headwinds and macro uncertainty, private equity was still an active player in the M&A markets. Private equity accounted for 25% of aggregate Mergers and Acquisitions (M&A) activity last year, according to EY. In this blog post, Consultport takes you through main types of private equity strategies that firms employ. We also explore how firms seize lucrative opportunities through effective private equity buyout strategies.

KEY TAKEAWAYS

- Three main types of private equity strategies are venture capital, growth equity, and buyouts.

- Firms need to evaluate carefully its investment goals, review the focus of investment and consider diversifying private equity investments across vintages.

- Investors need to gear up for 2024 which is predicted to offer “tremendous opportunities” for private equity investment.

Main types of private equity strategies

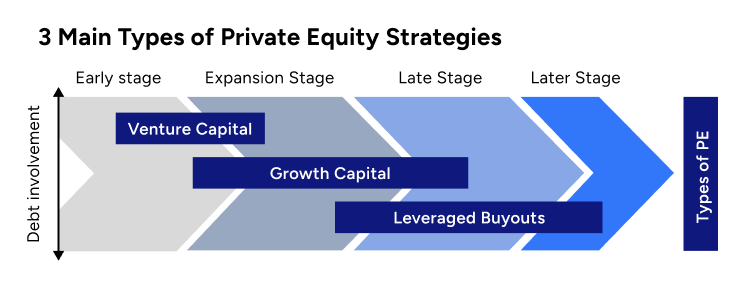

According to the Harvard Business School, there are three main types of private equity strategies. They are venture capital, growth equity, and buyouts. Let’s have a close look at each of them to have an overview picture.

Venture capital investment is risky as whether the startups can make a profit is highly uncertain. The return on investment is not guaranteed. However, if a startup is a big hit, venture capitalists can earn millions or even billions of dollars.

Unlike venture capital investment, growth equity investors can obtain a significant amount of data and information about the company’s performance. It can be through financial track record, interviews with clients.

Though all types of investments are potentially risky, with growth equity, the company can prove its ability to provide a return.

Successful growth equity strategy involves “a keen eye for a strong founder or team”, and careful research and financial analysis and projection, according to the Harvard Business School.

There are two types of buyouts:

There are three main levers that private equity managers generate returns from operational value creation, capital structure optimization, and change in valuation multiples.

Venture capital

This type of investment is often made in an early stage of the startup. The company receives a certain amount of seed funding from venture capitalists who in return get a share of it.Venture capital investment is risky as whether the startups can make a profit is highly uncertain. The return on investment is not guaranteed. However, if a startup is a big hit, venture capitalists can earn millions or even billions of dollars.

Growth equity

Growth equity is capital invested in an established company that needs additional funding to further grow.Unlike venture capital investment, growth equity investors can obtain a significant amount of data and information about the company’s performance. It can be through financial track record, interviews with clients.

Though all types of investments are potentially risky, with growth equity, the company can prove its ability to provide a return.

Successful growth equity strategy involves “a keen eye for a strong founder or team”, and careful research and financial analysis and projection, according to the Harvard Business School.

Buyouts

Compared to the first two investment types, buyouts occur in much later stages of the company lifecycle. It takes place when the company is purchased by a private equity firm or current management team.There are two types of buyouts:

- Management buyouts: this is a good option if there is a need for internal restructuring and if a company wants to go private before implementing structural changes. This enables investors and stakeholders to gain profit from their shares before the company is taken over.

- Leveraged buyouts: this works for companies that want to have major acquisitions without high capital spending. The loans to finance the buyout are secured by the assets of both the acquiring and acquired companies.

There are three main levers that private equity managers generate returns from operational value creation, capital structure optimization, and change in valuation multiples.

Guide for Effective Private Equity Buyout Strategies

In light of intense competition, investors need to develop a strong private equity buyout strategy According to experts, effective strategies involve the development and review of:- Investment goals: investors need to choose the right investment type based on the goal they set. There are four main categories of goals that investors seek for. They are growth, value, income, and diversification.

- Focus of investment: a majority of funds direct their strategies on a specific industry sector and operate in a particular region. Companies need to consider sectors that have the potential for diversification benefits. They should also consider other regions that might offer geographic diversification benefits and those that benefit from macroeconomic trends, according to an article on private equity investment.

- Diversification across vintages: the reasons for diversifying private equity investments across vintages include smoothing market cycles and the creation of a self-funding portfolio.

- Industry attractiveness evaluation: the assessment can be based on growth potential, profitability, competitive intensity, regulatory environment, and cyclicality. These elements indicate whether firms can successfully identify attractive targets, create value, and exit.

- Value driver identification: the drivers are the key elements that drive the performance and valuation of the portfolio firms. These drivers affect the cash flows, and margins of the businesses and can vary according to the industry, business model, and stage of the development of the company.

- Performance data analysis: it is important to analyze performance data of the private equity firms and their portfolio companies. The analysis offers insights into the trends and patterns. It also reveals the gaps, opportunities, and challenges posed. Performance data can be found in industry reports, case studies, interviews, databases, and surveys.

- Future trends prediction: firms need to take into account trends that can influence the demand, supply, and dynamics of the industry. The changes can bring opportunities or threats, including technological advancements, consumer preferences, and environmental regulations.

- Hypothesis testing: this final step involves testing the assumptions and forecasts about the attractiveness, value drivers, performance, and future trends of the private equity firms.

Risk considerations

To minimize risks, it is very important for firms to conside following factors when they develop private equity buyout strategies:

- Manager selection and access: the success of a private equity buyout strategy and return can be driven largely by the ability of a manager to source potential deals and add value. According to the Harvard Business Review, a private equity company often reviews several potential targets for every deal it closes. Competent managers utilize their networks and connections to find new deals.

- Business risk: All steps in the buyout investment process have a certain level of business risk. For example, the PE firm may not be able to restructure the company to create additional value.

- Liquidity and volatility: A buyout is often seen as a long-term, illiquid investment because it can take years for the creation and restructuring of value to play out. Therefore, capital is locked up for long periods. The periodical valuation of buyout investments by the owners of the company may make them less volatile in a portfolio.

Conclusion

The challenging macro environment has posed more and more difficulties for buyout investors in many regions and market segments since 2022, according to Partners Group. This consequently affects returns they rely on.

These challenges urge managers to adapt their approach to the forces that shape the investment environment.

In their recent report, EY predicted that 2024 is likely to offer “tremendous opportunities” for firms with diversified platforms, flexible approaches, and depth of experience despite the headwinds.

Don’t hesitate to reach out to Consultport if you are seeking assistance with a private equity buyout strategy for 2024. Our team of talented consultants collaborate closely with firms to capitalize the most lucrative opportunities.

These challenges urge managers to adapt their approach to the forces that shape the investment environment.

In their recent report, EY predicted that 2024 is likely to offer “tremendous opportunities” for firms with diversified platforms, flexible approaches, and depth of experience despite the headwinds.

Don’t hesitate to reach out to Consultport if you are seeking assistance with a private equity buyout strategy for 2024. Our team of talented consultants collaborate closely with firms to capitalize the most lucrative opportunities.

Share this article

Premium content,

on a weekly basis.

on a weekly basis.

Subscription implies consent to our privacy policy.

×

Premium Content, on a Weekly Basis

Subscribe to the Consultport Blog for expert insights on consulting, digital transformation, and the future of work, delivered straight to your inbox.

Discover our Consultant's Expertise

Ready to get access to the world’s best consultants?