A 5-Step Approach to Build an Effective PMI Strategy

Building an effective Post-merger integration (PMI) strategy is a critical factor in the success of mergers and acquisitions (M&A). In 2024, global mergers and acquisitions (M&A) activity experienced an 8% increase, reaching $3.4 trillion in value, thus approaching pre-pandemic levels. Projections for 2025 suggest a further rise, with estimates indicating a 10% growth in overall M&A volume.

Despite this upward trend, many M&A transactions fail to achieve their anticipated value. Approximately 70% to 90% of mergers do not meet expectations, with ineffective post-merger integration (PMI) strategies being a primary factor. Cultural misalignment, inadequate due diligence, and poor strategic planning contribute to these shortcomings.

Corporate leaders must focus on effective PMI strategies to realize the intended synergies of a merger and to enhance the likelihood of success in their transactions. This article builds on the best practices of successful mergers from the past, giving a 5-step approach to get PMI right.

The Stark Reality of PMI: Why Most Mergers Fail

Mergers and acquisitions (M&A) frequently fail to deliver their promised value. WSJ’s research reveals that 60% of M&A deals do not meet their strategic goals within the expected timeframe, and nearly 70% fail to realize their announced synergies.

High-profile failures include:

- Microsoft’s acquisition of Nokia: A $7.9 billion deal that resulted in a 96% write-off within a year due to an ineffective PMI strategy.

- Google’s purchase of Motorola: Bought for $12.5 billion and sold for $2.9 billion, resulting in a $9.6 billion loss, highlighting the importance of an effective PMI strategy.

The Hidden Risks Beyond Financial Metrics

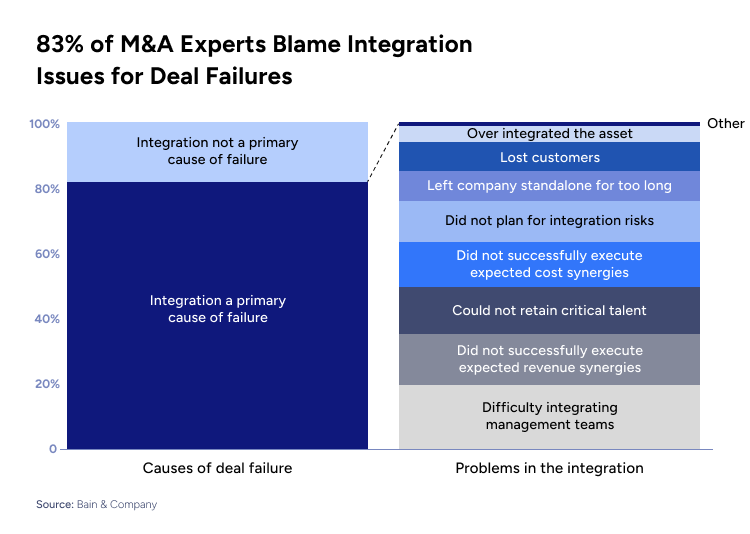

While financial metrics dominate deal assessments, an ineffective post-merger integration (PMI) strategy is one of the most important causes of failure. A report from Bain & Company states that 83% of unsuccessful deals cite poor integration as the root cause.

- Management and Culture Integration Issues: Leadership conflicts and unclear decision-making slow down integration and disrupt operations. Moreover, companies often underestimate the impact of cultural differences. A mismatch in values, leadership styles, and operational norms leads to employee disengagement and productivity loss without an effective PMI strategy.

- Unrealized Revenue Synergies: Overestimated cross-selling and growth opportunities fail without aligned sales strategies. More than half of projected revenue synergies are not realized, primarily due to unrealistic assumptions made during deal planning.

- Loss of Critical Talent: The post-merger uncertainty typically leads to major employee departures, impacting performance and continuity in daily business operations.

- Missed Cost Synergies: Expected savings are not achieved due to underestimated complexities and hidden costs. Deloitte reports that technology integration issues contribute to up to 50% of failed synergies. Data migration errors, incompatible systems, and poor IT governance disrupt operations.

- Ineffective Leadership and Communication: Inconsistent or vague messaging fosters mistrust. Employees are more likely to leave when they feel uninformed about their future in the merged entity. Moreover, delayed decisions on leadership roles create instability. Research shows that talent attrition spikes when leadership clarity is lacking within the first 90 days post-acquisition.

Lessons from High-Profile M&A Successes and Failures

Despite these challenges, some companies have managed M&A integration effectively:

- Apple’s $404 million acquisition of NeXT (1997): This deal brought Steve Jobs back to Apple and introduced the core technology that powered macOS and iOS, contributing to Apple’s transformation into a global leader.

- Google’s $50 million acquisition of Android (2005): Google’s ability to integrate Android’s talent and technology helped establish its dominance in the mobile OS market, generating billions in revenue.

- Berkshire Hathaway’s acquisition of GEICO: Warren Buffett’s strategy focused on long-term integration, strong leadership alignment, and operational autonomy, turning GEICO into a key profit driver.

These successes highlight that building an effective PMI strategy requires more than financial acumen. It demands early preparation, strong leadership, cultural alignment, and disciplined execution. Conversely, failures often stem from neglecting these fundamentals, leading to poor synergy realization and value erosion.

5-Steps to Build an Effective PMI Strategy

Step 1: Start Early with Strategic Diligence

Build Your PMI Strategy as early as possible

The integration process should start as the acquiring company is about 80% certain the deal will proceed to ensure an effective PMI strategy. Waiting until the deal closes often leads to missed opportunities and unaddressed risks. Early planning is essential for an effective PMI strategy: it allows for the proactive identification of potential integration challenges, the assessment of cultural compatibility, and the preparation for operational shifts. Companies that delay integration planning face execution risks, including loss of key talents, misaligned strategies, and unmet synergy goals.

Align Synergy Goals with Acquisition Strategy

Synergy is the cornerstone of acquisition success. To achieve it, companies must embed synergy objectives into the deal’s strategic framework from the outset. This means clearly defining expected cost savings, revenue growth, or market expansion goals during the diligence phase—not after. A detailed synergy roadmap ensures that all the tasks in the PMI strategy directly contribute to the acquisition’s value drivers, such as operational efficiency, resource sharing, and cross-selling opportunities.

Use Data to Drive Decisions

Data-driven insights are critical for uncovering hidden risks and validating assumptions. During due diligence, companies should leverage data analytics to:

- Identify Operational Risks: Assess gaps in processes, systems, and compliance.

- Evaluate Talent and Leadership: Determine which key roles are essential for post-merger success and identify potential leadership gaps.

- Validate Synergy Assumptions: Quantify potential cost savings and revenue synergies, using historical performance data, benchmarking, and predictive analytics.

For example, Emerson’s acquisition of National Instruments demonstrated how thorough due diligence—focused on synergy targets and technical integration—can accelerate post-deal value creation. By the time the deal closed, Emerson had already mapped out key operational synergies, reducing the time needed to realize financial benefits, and building the foundation for an effective PMI strategy.

Step 2: Build a Strong Leadership and Governance Structure

Appoint an Integration Leadership Team

Effective PMI strategies need strong leadership to succeed. Within two weeks of deal closure, appoint senior leaders from both organizations to oversee the integration. This team should include executives with experience in managing large-scale transitions. Their role is to set integration priorities, allocate resources effectively, and maintain strategic alignment. Cross-functional representation—from finance, HR, IT, and operations—is critical to address the challenges that arise during integration.

Consultport's Post Merger Integration Toolkit offer a ready-to-use template to manage the first 100 days of your PMI strategy, providing also a checklist to set the right priorities and align workstreams.

Clarify Roles and Decision-Making Authority

Ambiguity in roles leads to delays and conflicts. Define leadership responsibilities and decision-making authority early in the process. Establish an integration governance structure that specifies who is responsible for key decisions at every level. This includes setting up an integration management office (IMO) to coordinate activities, monitor progress, and ensure accountability. Clear reporting lines help avoid duplicated efforts and streamline the PMI strategy execution.

Retain Talent

Talent loss after a merger can erode the deal’s value. Within the first 30 days, identify key employees—those with essential skills, institutional knowledge, and leadership potential—and develop targeted retention plans, including financial incentives and career development opportunities, to secure their commitment. Regular check-ins and transparent communication reduce uncertainty and address common reasons for post-merger attrition. Leadership evaluations within the first 90 days help identify gaps and ensure the right people are in the right roles to support the new organization.

Step 3: Align Cultures to Foster a Unified Organization

Assess Cultural Differences

Cultural misalignment is a leading cause of M&A failures. According to PwC, two thirds of post-merger integrations struggle due to cultural contrasts. Conducting a culture audit during the due diligence phase helps identify gaps early. This includes employee surveys, interviews with key personnel, and analyzing existing HR data like turnover rates, promotion patterns, and internal communication styles. The goal is to pinpoint differences in leadership styles, decision-making processes, and work ethics that may affect integration.

Develop a Cultural Integration Plan

Once gaps are identified, create a cultural integration plan. Define the core values that both organizations will adopt. This may involve retaining elements from both cultures or establishing new shared values. Assigning “cultural ambassadors”—employees from both companies who exemplify these values—to drive the change internally is also relevant. For example, AVEVA’s acquisition of OSIsoft showed that leveraging common cultural priorities, like people-centric values, can ease the transition and strengthen employee engagement.

Communicate Transparently

Transparent communication reduces uncertainty and prevents rumors that can damage morale. Start with a clear message from leadership about the reasons for the merger and what it means for employees. Regular updates should follow, focusing on changes in roles, reporting structures, and company policies. Open forums, Q&A sessions, and feedback channels allow employees to voice concerns and feel heard.

Step 4: Execute with Operational Discipline

Create a Detailed Integration Roadmap

An integration roadmap defines the path from deal closure to full operational alignment. This plan should include specific objectives, timelines, and key performance indicators (KPIs). Objectives must align with the deal’s value drivers—whether cost synergies, revenue growth, or market expansion.

KPIs should cover financial metrics (cost reduction targets, revenue synergies), operational benchmarks (IT system migration completion rates), and employee-related metrics (retention rates of key talent). Tracking progress against these KPIs ensures accountability across teams.

Prioritize IT and Technology Integration

Technology integration failures account for up to 70% of missed M&A synergies. To avoid this, companies must address system compatibility, data migration, and cybersecurity from the outset.

Best practices include:

- Mapping and Managing Data Effectively: Identify all data repositories and plan migrations to minimize downtime.

- Standardizing IT Policies: Establish uniform access controls, compliance protocols, and security measures.

- Eliminating License Waste: Conduct audits to identify redundant software licenses, reducing unnecessary costs.

Delays in integrating core IT systems can disrupt business operations, leading to customer dissatisfaction and employee attrition.

Protect Core Value Drivers

Core value drivers vary by deal but often include talent, intellectual property, customer relationships, and operational capabilities. Protecting these assets requires:

- Leadership Evaluation: Assess leadership alignment within 90 days post-acquisition. Replace or reposition leaders whose management style conflicts with the new organization.

- Retention Strategies for Critical Talent: Identify key employees early and implement retention packages to reduce attrition risk.

- Safeguarding Customer Relationships: Maintain consistent communication with key clients to prevent churn during the transition.

Execution discipline in these areas helps companies realize the intended benefits of M&A deals while minimizing integration risks.

Step 5: Drive Continuous Improvement and Long-Term Value

Monitor Progress and Adapt Quickly

Integration doesn’t end with the closing of a deal. Regularly tracking progress against defined milestones is essential. Companies that succeed in post-merger integration (PMI) set measurable targets related to cost synergies, revenue growth, and talent retention. They review these metrics quarterly to identify gaps early.

Unexpected challenges are common. Leadership teams should be prepared to adapt, reallocate resources, or revise integration plans based on real-time performance data. This flexibility helped Dell rapidly pivot its cross-selling strategy during the EMC acquisition, accelerating revenue synergies beyond initial projections.

Capture Lessons Learned

Each M&A deal provides lessons that can improve future integration efforts. Successful acquirers document what worked and what didn’t, creating a feedback loop. Companies should create detailed “post-mortem” reports after every deal, covering areas such as leadership decisions, cultural alignment issues, and IT integration pitfalls.

These reports are not just archived—they’re actively used to refine playbooks, update due diligence checklists, and enhance leadership training. For example, gaps identified in talent retention strategies after one deal might lead to earlier leadership evaluations in the next.

Build a Repeatable Integration Model

Organizations with strong M&A track records treat integration as a core competency. They develop standardized frameworks that guide each new acquisition, reducing variability and risk. This should include a repeatable model focused on decentralized management, enabling acquired companies to retain operational autonomy while aligning with financial performance targets.

Key components of an effective PMI model include:

- Standard Operating Procedures (SOPs): Covering integration timelines, decision-making protocols, and governance structures.

- Integration Playbooks: Detailing best practices for functional areas like IT, HR, finance, and operations.

- Knowledge Repositories: Centralized databases storing lessons learned, case studies, and process improvements from past deals.

Companies that invest in these models consistently outperform peers, as seen in the Bain & Company data showing frequent acquirers achieve higher shareholder returns over 20 years compared to infrequent acquirers.

Consider Hiring a PMI Consultant

To build an effective PMI strategy, consider hiring a PMI consultant. Hiring Post-Merger Integration (PMI) consultants helps companies manage mergers more effectively, as many companies lack the internal skills needed for PMI. To have a glimpse of the situation, a KPMG study focusing on Finnish companies revealed that only 37% of listed companies rated their PMI/PMO (Project Management Office/Post-Merger Integration) function skills as high, indicating that approximately 63% recognized deficiencies in this area.

As a result, the PMI consulting market is booming, projected to grow from USD 8 billion in 2023 to USD 22.3 billion by 2031, reflecting a CAGR of 10.2%. Companies are increasingly recognizing the need for specialized expertise to mitigate risks, accelerate integration timelines, and unlock synergies effectively.

Freelance PMI consultants of Consultport’s network, offer flexible and cost-effective solutions. They can be hired for specific projects without long-term contracts. This allows companies to adjust resources as needed. Freelance consultants often have experience across different industries and projects, which helps them identify and solve problems quickly. They can start immediately, reducing delays in the integration process.

Given the high failure rate of mergers due to poor integration and the clear lack of internal expertise, companies benefit from hiring specialized PMI consultants. This approach reduces risks and increases the chances of a successful merger.

Want to know more? Find a consultant with Consultport.

on a weekly basis.