Why Firms Need to Conduct Due Diligence in M&A

Share this article

Mergers and Acquisitions (M&A) have been viewed as a critical strategy for firms with plans to expand their business. M&A helps companies in a number of ways. It enables economies of scale and scope, facilitates synergies, helps firms increase market share and enhance their competitiveness, just to name a few.

Amazon, the giant retailer, closed a 3.9 billion USD deal to acquire One Medical in February this year. This deal is expected to turn Amazon into a provider of primary medical care with access to more than 200 brick-and-mortar doctors’ offices, and nearly 815,000 One Medical members, CNN cited the company’s financial statement.

This is among tens of thousands of M&A deals taking place every year worldwide. In 2022, approximately 50,000 M&A transactions were completed globally, according to Statista.

Due diligence is an important process in M&A. It involves the verification, examination or audit of facts and information in a potential deal or investment opportunity. It is also conducted to identify potential defects and avoid risky transactions.

Due diligence helps to enhance the quality of information, therefore it enables an informed decision-making process.

In this blog post, Consultport focuses on why due diligence is so important in M&A activities. We also explore three major types of this process: financial, legal and operational due diligence.

Amazon, the giant retailer, closed a 3.9 billion USD deal to acquire One Medical in February this year. This deal is expected to turn Amazon into a provider of primary medical care with access to more than 200 brick-and-mortar doctors’ offices, and nearly 815,000 One Medical members, CNN cited the company’s financial statement.

This is among tens of thousands of M&A deals taking place every year worldwide. In 2022, approximately 50,000 M&A transactions were completed globally, according to Statista.

Due diligence is an important process in M&A. It involves the verification, examination or audit of facts and information in a potential deal or investment opportunity. It is also conducted to identify potential defects and avoid risky transactions.

Due diligence helps to enhance the quality of information, therefore it enables an informed decision-making process.

In this blog post, Consultport focuses on why due diligence is so important in M&A activities. We also explore three major types of this process: financial, legal and operational due diligence.

Why Due Diligence is Important

Despite the growth of M&A, one may wonder why there is a need to acquire and merge companies. There are two strategic reasons for these deals, according to Harvard Business Review.

In addition, a company can also lower costs thanks to the acquisition. The buyer utilizes certain acquired resources and shut down redundant resources. This means that it uses the new resources to enable scale economics to lower the costs.

Acquisition can be a strategy to respond to the change.

According to a report by McKinsey in late 2022, surveyed companies are building 50 percent more new businesses per year than they did two to five years ago.

The business leaders expect that new products, services and businesses will deliver nearly 30 percent of their revenues by 2027, said the report.

M&A generally involves a substantial amount of careful due diligence from the buyer. They want to have a good understanding of the target company. It includes the seller’s contingent liabilities, controversial contracts, litigation risks, intellectual property issues, among many others.

Let’s further explore the most significant types of due diligence in M&A transactions: financial, legal and operational due diligence.

1. Leverage performance

Acquiring a firm can leverage the buyers’ performance in terms of capabilities and products. Many acquire resources to command a price premium through enhancing a product or service that has customers willing to pay for improved functionality. To this end, firms obtain enhanced components through their internal development or purchase.In addition, a company can also lower costs thanks to the acquisition. The buyer utilizes certain acquired resources and shut down redundant resources. This means that it uses the new resources to enable scale economics to lower the costs.

2. Reinvent the business model

Very often, a firm would need to create a new business model when the existing models fade in the light of increasing competition and technological advancement.Acquisition can be a strategy to respond to the change.

According to a report by McKinsey in late 2022, surveyed companies are building 50 percent more new businesses per year than they did two to five years ago.

The business leaders expect that new products, services and businesses will deliver nearly 30 percent of their revenues by 2027, said the report.

M&A generally involves a substantial amount of careful due diligence from the buyer. They want to have a good understanding of the target company. It includes the seller’s contingent liabilities, controversial contracts, litigation risks, intellectual property issues, among many others.

Let’s further explore the most significant types of due diligence in M&A transactions: financial, legal and operational due diligence.

KEY TAKEAWAYS

- Due diligence in M&A involves the verification, examination or audit of facts and information in a potential deal or investment opportunity.

- Three types of due diligence that every M&A transaction needs are financial, legal and operational due diligence. They are essential for firms to make informed decisions.

- The M&A market has become more mature with varying trends. This requires firms to conduct careful due diligence processes to minimize risks and maximize value of the deal.

Financial Due Diligence

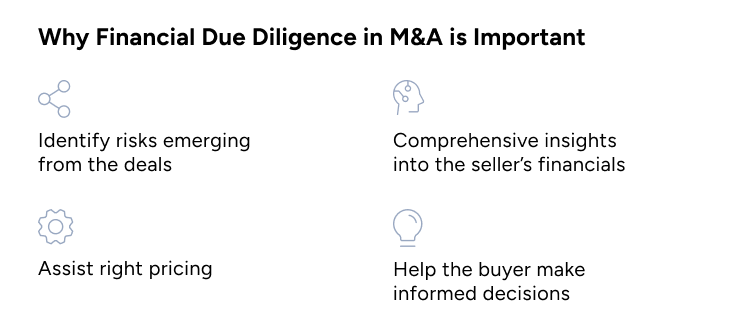

Why is it important?

Financial due diligence in M&A refers to the process of examining the accuracy of financial information shown in the Confidentiality Information Memorandum.This process aims to offer a comprehensive insight into the company’s financials. It also aims to detect the risks emerging from the transaction, from which a strategy is developed to minimize the risk. In addition, findings from financial due diligence in M&A help businesses make informed decisions to invest or exit the transaction. Sometimes, the findings also result in a lower pricing.

Financial due diligence therefore plays an indispensable role in an M&A transaction. Depending on different transactions, acquirers will need partial or full due diligence exercises to be undertaken.

The process

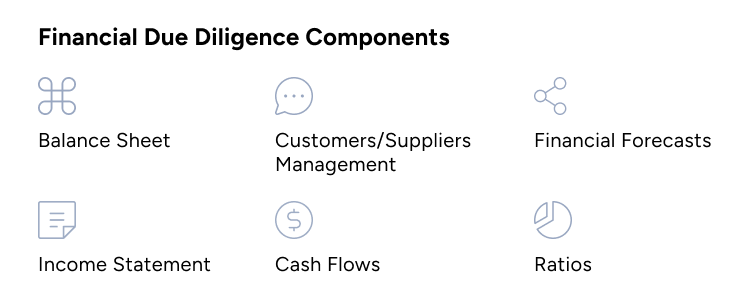

According to Forbes, buyers are interested in all historical financial statements and other relevant metrics of the sellers. They also want to look at whether the forecast of future performance is reasonable and realistic.Similarly, Crowe suggests that financial due diligence should incorporate the following information:

- Balance sheet: assets and liabilities, impairment of assets, recoverability issues, cash and borrowing, working capital analysis. Buyers may be interested in the annual, quarterly and even monthly financial statements of at least the last three years.

- Cash flows: net cash flow from operating, investing and financing activities, and cash conversion cycle.

- Financial projections: acquirers may review and inquire about the reasonableness and feasibility of the forecast.

- Ratios: liquidity, profitability, trade receivables, payables, inventories turnover days.

- Tax: corporate tax and indirect tax review, compliance with taxation legislation

- Income statement: revenue, gross profit margins, profit before/after tax, among others.

- Customers/suppliers/management: review of key customers, suppliers, material contracts and management personnel.

Legal due diligence

Why is it important?

Legal due diligence in M&A involves detailed examination of the buy side’s past and current legal status. In specific, the process involves the collection and evaluation of legal documents and information of the seller.This is a critical process in M&A transactions as it helps both the buyer and seller identify potential legal risks. According to Lexology, legal due diligence is crucial in a M&A deal for a number of reasons.

It helps the buyer gain a better understanding of the target company, its fair price and future risks.

The process

The process of legal due diligence in M&A involves assessing legal structures, ownership, law compliance, stockholder agreements, management. The area of scrutiny also expands to contracts, leases, potential lawsuits, intellectual property, tax liabilities, environmental laws. It also includes organizational documents including company by-laws, limited liability agreements and stockholder agreements.According to Lexology and Bloomberg Law, legal documentation needed for an M&A deal includes:

- Material contracts: guarantees and credit agreements, employment agreements, customer and supplier contracts, equipment leases, government contracts, partnership or joint venture agreements.

- Employee and management issues: policies related to issues like sexual misconduct, discrimination, labor disputes, involvement of any key employees in the criminal proceeding or civil litigation.

- Litigation: pending or threatened litigation, governmental investigations involving the company or key officers.

- Data and privacy security: company policies related to privacy protection for employees and customers.

- Intellectual property: copyrights, trademarks, patents and other intellectual property, software owned or licensed as well as active royalty, fee and license agreement.

Operational Due Diligence

Why is it important?

Operational due diligence in M&A refers to the investigation of the business model and operations of the seller. It helps to ensure the deal is a good fit for the buyer.Specifically, the process focuses on examining if the seller’s operational activities can be sustained in the future without requiring extra funding beyond what the management has budgeted for. It also helps the buyer to develop action and investment needed to facilitate value creation processes.

The process

As each deal has its own unique characteristics, one must be flexible when it comes to approach for an operational due diligence.According to Deloitte, operational due diligence in M&A seeks to answer one of the following questions:

- Robustness of operations: to evaluate whether the seller’s operations are running smoothly, site visits, operational management interviews, and benchmarking KPIs are necessary to answer this question. The buyer needs to find out how well the seller is invested in, and whether the management is directing towards the right KPIs. it also looks at the seller’s performance against benchmarks, the feasibility of planned performance improvement savings.

- Operational benefits and full potential of the target: the buyer can pursue four main steps. Firstly, it establishes a benchmark or reference point for financial and operational metrics based on historical data. It then develops a hypothesis before testing it with data points. Finally it creates financial modeling of validated hypotheses.

- Types of synergies following a merger to be anticipated: the buyer is interested in the proof points needed to support estimates and assumptions made in measuring the synergies. It also wants to make sure whether the implementation plan is detailed enough. In addition, the buyer would also look at plans to capture the synergies.

Conclusion

The M&A sector has witnessed remarkable developments and become more mature in terms of approach and resources used in recent years.

With its proliferation, the trends in the M&A sector also vary. There has been an increase in cross-border M&A activities, growing interests in innovative startups, and increasing focus on environmental, societal and governance-based rating.

The maturity of the market and changing trends requires greater attention to due diligence to ensure firms make an informed decision. A careful due diligence process is essential to minimize risk and maximize value of an M&A deal.

Here at Consultport, we have a pool of talented consultants who help firms maximize the value of M&A transactions. They guide businesses on the right M&A strategy and opportunity prioritization. Don’t hesitate to contact us and together we maximize the value and return from acquisitions, mergers, divestitures, and company integrations.

With its proliferation, the trends in the M&A sector also vary. There has been an increase in cross-border M&A activities, growing interests in innovative startups, and increasing focus on environmental, societal and governance-based rating.

The maturity of the market and changing trends requires greater attention to due diligence to ensure firms make an informed decision. A careful due diligence process is essential to minimize risk and maximize value of an M&A deal.

Here at Consultport, we have a pool of talented consultants who help firms maximize the value of M&A transactions. They guide businesses on the right M&A strategy and opportunity prioritization. Don’t hesitate to contact us and together we maximize the value and return from acquisitions, mergers, divestitures, and company integrations.

Share this article

Premium content,

on a weekly basis.

on a weekly basis.

Subscription implies consent to our privacy policy.

×

Premium Content, on a Weekly Basis

Subscribe to the Consultport Blog for expert insights on consulting, digital transformation, and the future of work, delivered straight to your inbox.

Discover our Consultant's Expertise

Ready to get access to the world’s best consultants?