When and Why You Need an M&A Consultant

The Global M&A Market is currently declining, marking a continuation of the downward trend that started in 2022, with a forecasted recovery in the second half of 2024. However, during the same period, the Mergers and Acquisitions (M&A) Consulting Market has always grown at a CAGR of 2.5%, forecasted to hit a size of $34.5 Billion by 2032.

The primary driver behind this is the increasing risks associated with M&A transactions. Conducting rigorous due diligence projects, structuring deals that align with strategic objectives and PMI are becoming increasingly complex, halting many M&A transactions. This is mainly due to rising macroeconomic, geopolitical, and regulatory pressures.

Here is where M&A consultants bring value. M&A consultants play an important role in ensuring that M&A transactions are executed efficiently and effectively, helping companies navigate the financial, operational, and regulatory challenges that can arise during the process.

This article will delve into these challenges and the main value added by M&A consultants, answering these questions:

- What specific challenges do companies face during M&A transactions?

- Which are the main types, roles, and expertise, of M&A consultants?

- What strategies and methods do M&A consultants use?

M&A Market Outlook

Deal Volume and Value Growth

In the first half of 2024, global M&A deal volumes had dropped by 25% compared to the first half of 2023. Despite this decline in deal volumes, deal values increased by 5%, largely driven by megadeals (transactions over $10 billion) in the technology and energy sectors.

Deal volumes stood slightly above 23,000, with deal values reaching $1.3 trillion, a significant drop from the nearly 34,000 deals and $2.7 trillion peak in the second half of 2021. This reduction was influenced by ongoing macroeconomic, geopolitical, and regulatory pressures, which also led to a 17% decrease in megadeals.

Despite these challenges, companies began adapting their M&A strategies to the difficult economic conditions of 2024, characterized by high interest rates and increased regulatory scrutiny.

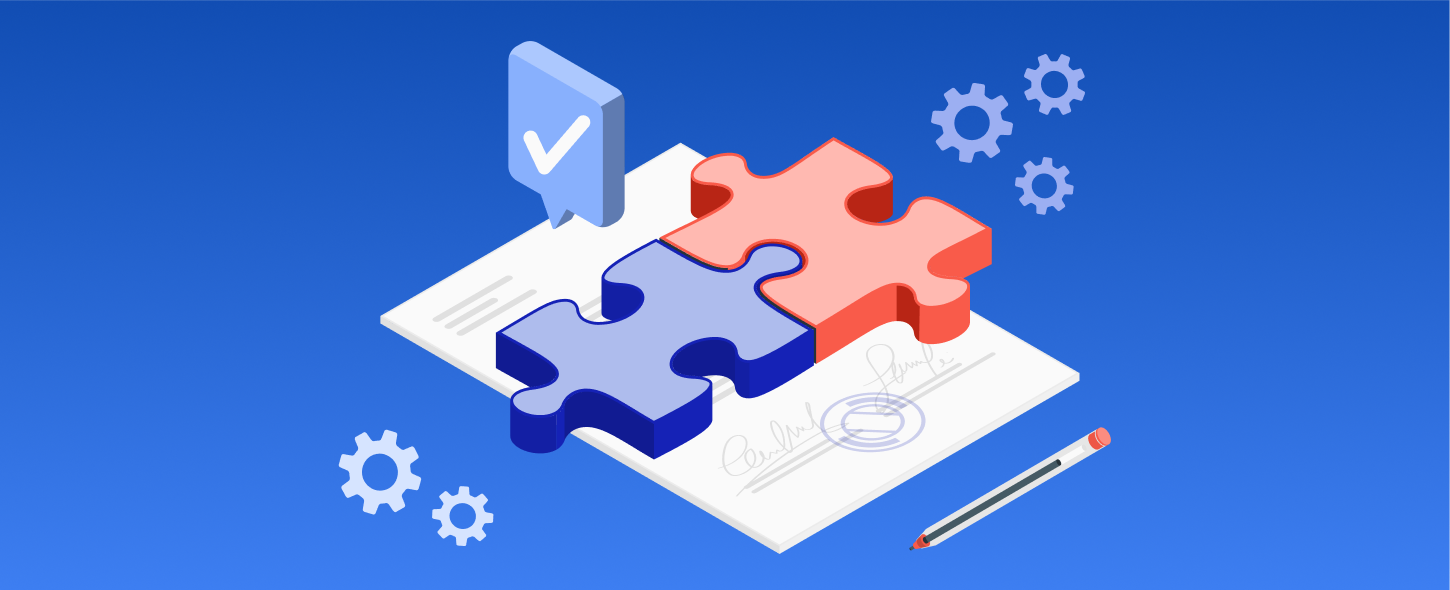

2024 Forecasts: Main Sectors driving M&A Rebound

The outlook for the M&A market in 2024 remains cautiously positive, driven by the growth in:

- Technology Sector: Technology continues to be a hotspot for M&A, particularly as companies seek to expand their digital capabilities through acquisitions. The technology sector is experiencing the strongest growth in 2024, nearly doubling its M&A activity compared to 2023. A notable example is Synopsys's $35 billion bid for Ansys in January 2024, aimed at integrating advanced AI capabilities.

- Energy Sector: The energy sector leads in global M&A value, driven by significant investments in renewable energy and infrastructure. For instance, ExxonMobil’s $60 billion bid for Pioneer in late 2023 is a crucial example of the ongoing trend in ESG and commodities-focused deals.

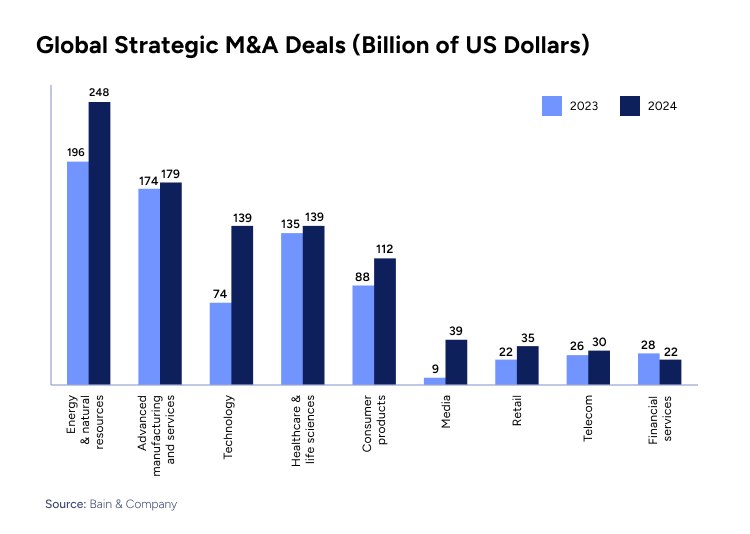

- Private Equity Sector: As underlined by Morgan Stanley, after the peak in 2021, driven by favorable market conditions, the value of exits began to decline, dropping by 37% in 2023. However, with the Federal Reserve indicating a potential easing of monetary policy in 2024, there could be a resurgence in PE exit activity. Supported by over $2 trillion in “dry powder”, financial sponsors may accelerate both buying and selling activities as conditions improve.

The main Challenges for Successful M&As

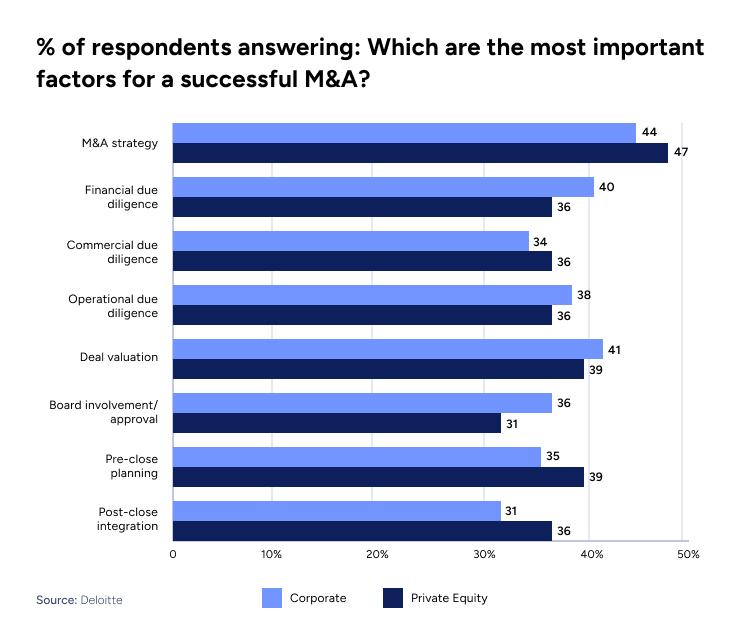

With recent challenges reshaping the M&A market, such as geopolitical tensions, political uncertainty, and an inverted bond yield curve, both corporate and private equity dealmakers are placing greater importance on having a well-defined and well-supported M&A strategy.

In a recent Deloitte Survey, 47% of private equity respondents and 44% of corporate respondents assessed that having a well-defined M&A strategy is the most critical factor for M&A success. As the second most important factor, corporate leaders prioritize financial due diligence, while private equity leaders focus on deal valuation and pre-close planning as a major success factor for M&A Strategies.

As deal values continue to increase, corporate executives are reporting higher expenditures on M&A integration and strategic planning than ever before. PwC's 2023 M&A Integration Survey found that approximately 59% of companies surveyed spent 6% or more of the deal value on integration, which often includes substantial involvement from external advisors.

M&A Consultants: Their Role and Expertise

More challenging economic conditions and regulatory environments make it harder for companies to maintain the necessary expertise internally. In response, many organizations are turning to external consultants to bridge these gaps: nearly 60% of companies cite the lack of in-house expertise as a primary reason for engaging them.

Independent consultants offer a more flexible and cost-efficient alternative to traditional consulting firms. Platforms like Consultport are facilitating this shift by connecting organizations with highly skilled independent consultants, enabling companies to access the specific expertise required for successful M&A integration and strategy execution.

M&A consultants can be classified into five key categories:

- Due Diligence Specialists

- Valuation Experts

- Carve-Out Consultants

- Negotiation and Deal Structuring Experts

- Post-Merger Integration (PMI) Consultants.

Each focuses on different aspects of the M&A process.

Due Diligence Consultants

Due Diligence Consultants assess financial, operational, and legal risks during mergers and acquisitions. They are particularly crucial in cross-border transactions or acquisitions involving distressed assets, where the financial transparency of the target company might be questionable.

With certifications like Certified Fraud Examiner (CFE) or Chartered Accountant (CA), qualified Due Diligence Specialists are proficient in forensic accounting tools such as IDEA and ACL Analytics. Moreover, they can also bring experience in the implementation of Advanced Driver Assistance Systems (ADAS) and Autonomous Driving (AD) technologies in sectors in which it is particularly important such as automotive engineering or software development.

Valuation Experts

Valuation Experts are essential in determining the fair market value of businesses, assets, or equity in M&A deals. Companies should engage them when negotiating deal terms based on the accurate valuation of intangible assets or future growth potential.

Moreover, Valuation Experts are valuable in high-value deals or acquisitions of companies in volatile markets. They use advanced valuation techniques from Discounted Cash Flow (DCF) Analysis to Comparable Company Analysis (CCA) to provide accurate valuations. Real Options Valuation is often employed for industries with high growth potential, such as technology and pharmaceuticals.

A Valuation Expert should hold certifications like Chartered Financial Analyst (CFA) or Accredited Senior Appraiser (ASA) and be proficient in tools such as FactSet and Capital IQ. They should have extensive experience in financial modeling, deal valuation, and deal structuring.

Carve-Out Consultants

Carve-Out Consultants manage the separation of a business unit from its parent company, focusing on value retention and minimizing disruption. They are crucial for divestitures or when a subsidiary needs to operate independently shortly after the transaction, especially in complex financial situations.

They employ Financial Segmentation tools to accurately separate financials, use ERP systems like SAP for seamless data transfer, and structure Transition Service Agreements (TSAs) to manage ongoing operational support.

Qualified Carve-Out Consultants should have a strong background in finance and operations, with experience in handling complex separations. Proficiency in ERP systems like SAP for managing data and operational transfers is essential, along with expertise in structuring Transition Service Agreements (TSAs). They should have previous experience with carve-out analysis and budget separation, as well as IT transformations in carve-out situations.

Negotiation and Deal Structuring Experts

Negotiation and Deal Structuring Experts are pivotal in crafting and negotiating deal terms that optimize financial and strategic outcomes. These experts should be engaged in high-stakes M&A transactions where the deal's success depends heavily on the terms negotiated, such as in highly competitive bids, cross-border transactions, or when complex financial structures are involved.

They apply critical tools like BATNA (Best Alternative to a Negotiated Agreement), Integrative Negotiation Strategies, and advanced financial modeling to secure favorable terms and ensure the deal aligns with the company’s strategic objectives.

Negotiation and Deal Structuring Experts should have extensive experience in financial modeling, commercial due diligence, and structuring complex M&A deals. They should be proficient in building and analyzing business cases and possess a strong understanding of private equity and venture capital deal dynamics.

Post-Merger Integration (PMI) Consultants

Post-Merger Integration (PMI) Consultants ensure that merging companies are integrated seamlessly, focusing on aligning operations, technologies, and culture to realize projected synergies. They are especially valuable in large-scale mergers where the integration process is complex and involves multiple business units or geographies.

PMI Consultants should have robust project management and operational integration skills, often evidenced by certifications like PMP or Six Sigma Black Belt. Proficiency in using tools like SAP ERP for systems integration, Workday for human capital management, and Power BI for tracking synergy realization is critical. Post-Merger Integration (PMI) Consultants have extensive experience in managing PMI projects. They bring a strong background in project management, with a proven track record of leading and executing successful integrations across multiple business functions. PMI Consultants are typically responsible for driving the agenda collaborating closely with the C-suites, and own the overall PMI project management.

Consultport Case Study: Financial Due Diligence Project

The Challenge

A leading consulting firm needed support for the financial due diligence of one of its biggest clients in the Indian Market. The final client of the consulting firm, a major player in financial services, faced the challenge of ensuring that the financial health of the target company was thoroughly vetted before proceeding with the acquisition.

The main challenges were:

- Assess the accuracy of the financial statements and the integrity of financial reporting.

- Identify any hidden liabilities or risks that could potentially derail the deal.

- Acting as a bridge between the client's senior management and the target company’s executive team.

The client required a consultant with a deep understanding of the Indian financial market, substantial experience in conducting and leading financial due diligence, and a strong background in managing audit teams.

Role of Consultport

Recognizing the urgency and specific needs of the project, Consultport proposed two highly qualified candidates within 72 hours. The consulting firm ultimately selected a former Senior Consultant from L.E.K. Consulting, who had over 7 years of experience in financial due diligence, particularly in the Indian market.

The consultant had previously conducted 4 detailed financial analyses and audits for high-value M&A transactions, leading the audit teams through rigorous financial reviews, ensuring accuracy and compliance with international and local accounting standards.

Approach

The consultant started the engagement by developing a detailed project plan that outlined each phase of the due diligence process, ensuring that all key areas were thoroughly examined. The approach included:

- Initial Assessment and Data Gathering: Extensive review of the target company's financial records, including balance sheets, income statements, and cash flow statements, using advanced financial modeling techniques to verify the accuracy of the reported figures.

- Forensic Accounting and Risk Identification: Use of forensic accounting methods to perform variance analysis and detect discrepancies between reported and actual financial performance.

- Stakeholder Engagement and Communication: Conduct regular meetings and sessions with the target company’s management, ensuring that all queries are addressed promptly. This direct engagement was crucial in clarifying potential red flags and gaining a deeper understanding of the company’s financial practices.

- Scenario Analysis and Stress Testing: Development of financial models to simulate various scenarios to assess the potential impact of different economic conditions or operational changes on the company’s financial stability. This stress testing was essential for understanding the potential risks under different market conditions.

- Final Due Diligence Report: Compilation of all findings into a comprehensive due diligence report, including risk assessments and actionable recommendations.

Results

The consultant’s approach led to the identification of significant financial discrepancies. Specifically, the consultant uncovered a 12% discrepancy in reported earnings and potential operational inefficiencies. The work supported the Consultancy Firm’s project and led to a 15% reduction in projected costs post-acquisition.

Key achievements included:

- Timely Delivery: The due diligence report was delivered on time, within the agreed six-week timeframe, ensuring that the M&A transaction remained on schedule.

- Risk Mitigation: The identification of financial discrepancies and operational inefficiencies helped mitigate potential risks, leading to a more favorable negotiation position for the client.

- Cost Savings: By engaging an independent consultant through Consultport, the client saved approximately 35% compared to the costs of hiring a traditional consulting firm or investment bank.

Overall, the consultant’s expertise and thorough approach ensured a successful due diligence process and provided the client with critical insights that strengthened their negotiation position.

Find a Consultant

Hiring an independent M&A Consultant offers specialized skills, flexibility, and cost-efficiency that traditional consulting firms often cannot match. By leveraging their deep industry knowledge and tailored approaches, companies can navigate complex deal processes more effectively, uncover hidden opportunities, and realize greater value from their acquisitions.

Ready to maximize the success of your next M&A deal? Discover Consultport M&A Consultants.

Javier is an M&A and Transaction Advisory consultant, with many years of experience in leading consultancies. He is specialized in supporting companies throughout the whole M&A process, including financial analysis, target valuation, due diligence, financial risk assessment, transaction planning, as well as deal execution. Javier is also an expert in developing financial models for valuations and business scenarios.

on a weekly basis.