How to Craft An Effective Market Entry Strategy

Introduction

Global expansion has become a significant driver of corporate growth, accounting for over half of all corporate growth in the last decade. Companies in Eastern Asia and Europe have relied heavily on extensive market entry in foreign markets to counteract slower growth at home.

However, successfully entering a new market requires more than just ambition: it demands a strategic approach tailored to the company’s strengths and the market's unique characteristics.

Effective market entry strategy begins with a thorough understanding of the competitive advantage in the home market, which can be leveraged internationally. Companies with strong domestic growth have reported an additional 2 percentage points in annual Total Shareholder Returns (TSR) through international ventures.

However, the path to success in global markets is not uniform. It requires a balance between standardization and local adaptation, and an understanding of the specific industry context, whether it's a sheltered local, export-oriented, multidomestic, or complex global business.

In this article, we will delve into the complexities of crafting a global expansion strategy, answering the following questions:

- How can companies harness their competitive advantage for successful global expansion?

- What factors must be considered when balancing standardization with local adaptation?

- What are the most effective market entry strategies for various business types?

- How do market entry consultants play a crucial role in navigating these challenges?

Global Expansion: A Driver for Corporate Growth

Typically, growth options start with a focus on the home market and the core business, but as the company grows, firms eventually embark on global expansion. Half of all corporate growth in the past decade came from foreign markets.

Companies’ benefits from international expansion vary significantly by region. For example, businesses in East Asia derived 55% of their total revenue growth from international markets, while those in Europe attributed 54% to foreign expansion.

In contrast, North American companies only gained 10% from global operations, relying more on local markets. Firms in Latin America experienced a 27% contribution from international regions, whereas Oceania saw the highest reliance on local growth at 84%, with only 8% coming from international regions.

In international markets, scope decisions often involve determining which products to offer in specific countries and whether to produce locally or export from existing facilities. These choices are shaped by several factors, such as the firm’s organizational capacity, the economic conditions and local demand of target markets, trade barriers, and competition.

The Secrets for a Successful Global Expansion

The Importance of an Exploitable Competitive Advantage at Home

As reported by McKinsey, the most critical factor for successful global expansion is the strength of a company’s competitive advantage in its domestic market. Companies with strong growth in their home markets generated an additional 2 percentage points of annual Total Shareholder Return (TSR) through international expansion, while companies struggling at home gained only 1.3 percentage points.

Thus, a clear and exportable competitive advantage is essential to thriving in international markets. Companies that excel domestically generally have proven business models and practices, which can be adapted to different local specificities. This gives a significant edge when entering new markets, allowing them to capture market share and outperform local competitors.

However, this is not always the case. The success is largely constrained by the nature of the industry:

- In multi-domestic industries, such as hotels and mass retail, competition occurs on a country-by-country basis. A firm's competitive advantage is largely specific to each market, and expanding across borders requires significant adaptation, as competitive strengths do not easily transfer.

- In global industries, such as automobile and aerospace, competition happens on a worldwide scale. A firm's position in one country is directly influenced by its performance in others. To succeed, firms must integrate activities across multiple markets and leverage their global presence (function of the level of FDI and the level of international trade).

As a result, firms must have a comprehensive understanding of their industry and business, as well as the foreign business environment before expanding abroad. Let’s explore this more in detail.

Each Business Requires Tailored Expansion Strategies

We can distinguish four types of international businesses, based on their levels of foreign direct investment (FDI) and international trade activity. Each type of business requires different strategic choices in terms of configuration of activities and production:

- Shelter local businesses are characterized by low levels of both FDI and international trade. These companies focus heavily on their local markets and gain a competitive edge by remaining highly localized. Their primary goal is to serve the home market, and they rarely venture into global markets. Examples include industries like railways, hairdressing, and local press services.

- Export-oriented global businesses typically have low FDI but high international trade. These companies produce their goods at the local level but sell their products globally, maintaining a global identity without moving their headquarters or altering their core operations. Industries such as aerospace, agriculture, and fine jewelry fall into this category.

- Multidomestic businesses operate with high FDI and low international trade. These companies are present worldwide but prioritize localization by adapting their products and services to meet local market needs. Although they are global, they often rely on local suppliers and cater to regional preferences. A notable example is McDonald's, which operates in many countries but modifies its menus to reflect local tastes.

- Complex global businesses have high FDI and high international trade, typically producing and selling standardized products on a global scale. These firms rely on intricate international supply chains, delocalizing production while maintaining low levels of adaptation. Examples include the automotive, pharmaceutical, and electronics industries, where products are typically standardized and sold worldwide.

Step-by-Step Guide for an Effective Global Expansion Strategy

When developing a global expansion strategy, companies must balance the need for standardization with the demands of local adaptation, carefully configure their production activities, and tailor their approach based on the type of business they operate, whether sheltered local, export-oriented, global, or multi-domestic.

Step 1: Choose Between Standardization and Adaptation

This choice implies a trade-off between the value and the cost of adapting to local needs:

Standardization allows firms to benefit from economies of scale, reducing costs while enhancing learning opportunities and operational efficiency. This approach is effective when companies can leverage their competitive advantage across markets without significant changes. However, too much standardization can limit a product’s appeal in foreign markets, reducing acceptability and market penetration.

On the other hand, adaptation becomes essential when a company operates in markets with unique cultural, administrative, or economic factors (CAGE framework). While it ensures local relevance, adaptation is costly, and firms risk losing efficiency and increasing complexity.

Step 2: Choose Between Concentration and Dispersion

Another major decision involves the choice between concentration or dispersion of production:

- Concentration involves centralizing production in a few plants that serve worldwide distribution. This approach enhances efficiency and cost control but may limit responsiveness to regional needs.

- Dispersing production allows companies to establish autonomous plants in multiple regions. These plants focus on local market demands, offering flexibility and quicker response times. However, this decentralization can increase operational complexity and cost. In some cases, firms choose a coordinated model where production is dispersed but focuses on specific regions (for instance, regional plants and warehouses).

Putting things together:

- Sheltered local businesses emphasize adaptation with decentralized dispersion, as they cater exclusively to local markets. This approach allows them to focus on home market needs, avoiding international competition.

- Export-oriented global businesses focus on standardization with concentration, since their competitive advantage lies in keeping standardized products while centralizing production. This strategy enables them to maintain product consistency and scale through international trade.

- Multidomestic businesses rely on adaptation with decentralized dispersion, tailoring products to local markets while maintaining a global presence. Their success stems from meeting regional preferences and working with local suppliers.

- Complex global businesses blend standardization and adaptation with coordinated dispersion, integrating global supply chains and minimizing adaptation. Their strategy maximizes efficiency by standardizing products, with some degree of adaptation to local markets, while operating across multiple markets.

Step 3: Craft Your Market Entry Strategy

There is no “one size fits all” approach, as each business requires different strategies to succeed in international markets. Depending on the industry and the business's overall ambition, companies can decide to export their products without having a physical presence in the market, or establishing a strong local presence through licensing, Joint Ventures, opening a subsidiary, or even an M&A.

Exporting

Exporting is the most common strategy for businesses wanting to enter foreign markets without setting up physical operations abroad. It is ideal for export-oriented businesses that wish to maintain centralized production while distributing products globally. There are four main ways companies can export their products:

- Buying Agents: These intermediaries work on behalf of foreign buyers, representing them in transactions with manufacturers. Suitable for businesses looking for minimal involvement in foreign markets, buying agents offer a simple, low-risk entry strategy, though at the cost of reduced profit margins.

- Distributors: Distributors purchase products from the exporter and resell them in the target market. This strategy is often used by companies that want to offload logistics, marketing, and sales functions to a local entity. While this approach limits control over pricing and customer relations, it provides fast market access.

- Trading Companies: These firms specialize in facilitating international trade and are valuable for businesses that lack expertise in foreign markets. By handling the complexities of international regulations, trading companies allow businesses to expand without directly managing the risks of foreign operations.

- Piggybacking: This involves partnering with a company that already has an established distribution network in the target market. The partner sells the product alongside its own, reducing the entry cost for the business. It’s a low-risk option for companies that want to test new markets without a large initial investment.

Establishing a Local Presence

For businesses that require a stronger foothold in foreign markets, establishing a local presence is essential. This strategy is usually favored by multidomestic and complex global businesses that want to exert greater control over their operations, branding, and customer relationships.

- Licensing and Franchising: For sheltered local businesses or companies with limited capital, licensing allows them to grant foreign partners the right to produce or sell their products. This strategy minimizes risk and capital investment while providing an entry into foreign markets. Franchising, on the other hand, involves replicating a successful business model in a foreign market, ideal for companies like fast-food chains or retail stores that want to expand while maintaining operational consistency.

- Joint Ventures and Partnerships: These are most beneficial for multidomestic businesses, which need local expertise to adapt their products and services to market-specific requirements. In a joint venture, the business shares ownership with a local partner, reducing risk and sharing resources. This approach allows the company to leverage local knowledge while ensuring that both parties benefit from the expansion.

- Open a Subsidiary: For complex global businesses, setting up a wholly-owned subsidiary offers complete control over operations. This strategy involves higher capital investment but provides the ability to directly manage branding, customer relations, and operational decisions. Establishing a subsidiary is suitable for companies seeking a long-term presence in a high-potential market.

- Merger and Acquisitions: This high-risk, high-reward strategy is often chosen by complex global businesses looking for fast entry into a market. Acquiring an existing local company provides immediate access to an established customer base, workforce, and infrastructure. However, mergers and acquisitions come with integration challenges, requiring careful due diligence and post-merger management.

Case Study: Market Entry to China for Consumer Service Company

One of Consultport's most recent Market Entry projects involved helping a leading consumer service company craft a successful strategy for entering the Chinese market, as a key part of their global expansion plan.

Consultport proposed three qualified market entry consultant profiles within 48 hours, and the client selected a consultant with a 10 years of experience at a top-tier consulting firm. The consultant had successfully managed six previous international market entry projects within the consumer services sector.

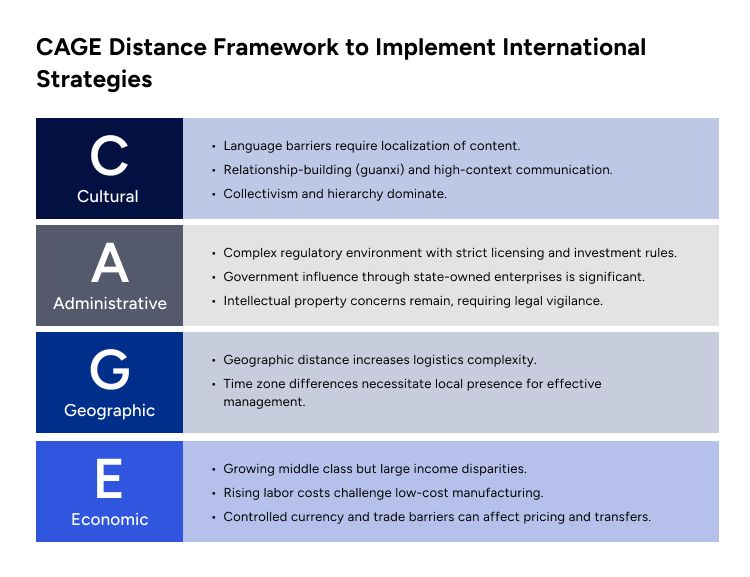

The consumer service industry is a typical example of a multidomestic business, where a company’s success largely depends on tailoring services to the specific needs, preferences, and regulations of each local market. Moreover, China posed unique challenges due to its cultural, regulatory, and competitive landscape. Following the CAGE framework:

- Cultural Distance: China presents significant cultural challenges that require precise localization, particularly due to language barriers. Building trust through long-term relationships (guanxi) is essential for successful negotiations. Furthermore, the collectivist culture and hierarchical structures in China demand that companies adjust their management styles to fit local expectations.

- Administrative Distance: China has strict licensing requirements and foreign investment restrictions. The government exerts substantial influence, primarily through state-owned enterprises that dominate critical industries. Intellectual property protection remains a concern, making legal safeguards necessary to avoid risks.

- Geographic Distance: Expanding into China involves significant logistical challenges due to the physical distance from Western markets. However, well-developed infrastructure in major cities facilitates distribution. Companies must address time zone differences, often by establishing local teams to manage day-to-day operations efficiently.

- Economic Distance: Rising labor costs in manufacturing hubs are shifting China from a low-cost production base to a more balanced market. Companies must also manage currency controls and trade regulations that affect pricing strategies and financial transfers.

As a result, a joint venture with a local partner was the best market entry solution. A joint venture allows the foreign company to leverage local expertise, regulatory understanding and established customer networks while sharing financial risks.

Thanks to the consultant's work, the client was able to identify three possible partners, ultimately forming a joint venture with a top Chinese consumer service company, reducing market entry risks by leveraging local expertise. Moreover, the consultant supported ensuring regulatory compliance, securing all necessary licenses within six weeks, and allowing the company to begin operations quickly and without legal issues.

Why Engaging With Market Entry Strategy Consultants

Market entry strategy consultants help companies bridge the gap between internal knowledge and critical market factors. While companies may have strengths like engineering expertise, they might miss key external details, such as the availability of local talent in a new market. Consultants bring objective insights, helping to assess opportunities thoroughly and avoid common pitfalls.

They focus on three main areas:

- Target Market Research: Consultants analyze market value, growth trends, and development prospects. They assess legislative processes, market barriers, and the business environment, including regulatory, technological, social, and political factors. This helps companies understand the market structure and potential challenges.

- Opportunity Analysis: Consultants evaluate the company’s capabilities, market size, and the competitive landscape. They provide insights into market share, revenue estimates, and entry costs. This helps determine if the company’s strengths, like engineering and marketing, will translate into success in the new market.

- Market Entry Recommendations: Based on their research, consultants advise on the best entry strategies, such as joint ventures, direct exporting, or partnerships. They also offer guidance on timing, speed of entry, and potential partnerships, ensuring the company is well-positioned for market success.

Freelance consultants, in particular, offer a cost-effective and adaptable solution, bringing deep industry knowledge and personalized attention. At Consultport, all consultants have extensive experience in international markets, helping companies crafting tailored strategies that align with the specific goals of the global expansion.

Want to discover more? Find a Consultant

on a weekly basis.