Finance Consulting Between Automation and Generative AI

The Finance Consulting market is growing quickly, driven by the initial use of AI in finance functions and plans to expand its integration soon. Over 61% of finance functions are still in the initial phases of AI adoption, but companies are increasingly recognizing the importance of these technologies, creating a significant demand for consulting services that can bridge this gap.

As organizations leverage advanced analytics, automation, and AI to improve financial operations, the role of finance consultants is expanding beyond traditional advisory. Consultants are now vital in helping businesses implement technologies like Robotic Process Automation (RPA) and generative AI, shaping tech-driven finance functions. This article will delve into these developments by addressing key questions such as:

- How is the Finance Consulting market evolving, and what role does AI implementation play in this expansion?

- How are finance functions transforming, and how can finance consulting assist in building advanced, tech-enabled finance operations?

- What are the current and future applications of generative AI in finance, and how can finance consulting facilitate its adoption?

- What unique advantages do freelance finance consultants bring to businesses in this dynamic environment?

The Current State of Finance Consulting Market and AI Implementation

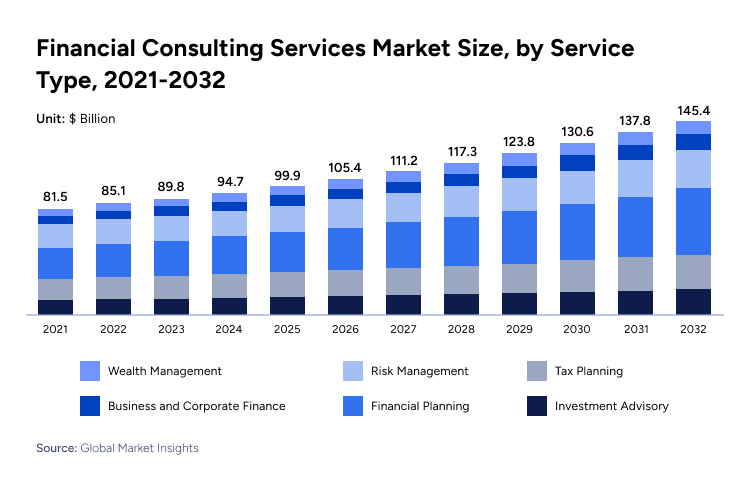

The Finance Consulting Market size was valued at USD 85.1 billion in 2022 and is projected to reach USD 145.4 billion by 2032, growing at a CAGR of 5.5% over the forecast period. In particular, Consulting in Wealth Management, Financial Planning, and Business and Corporate Finance are the ones prospecting the highest growth.

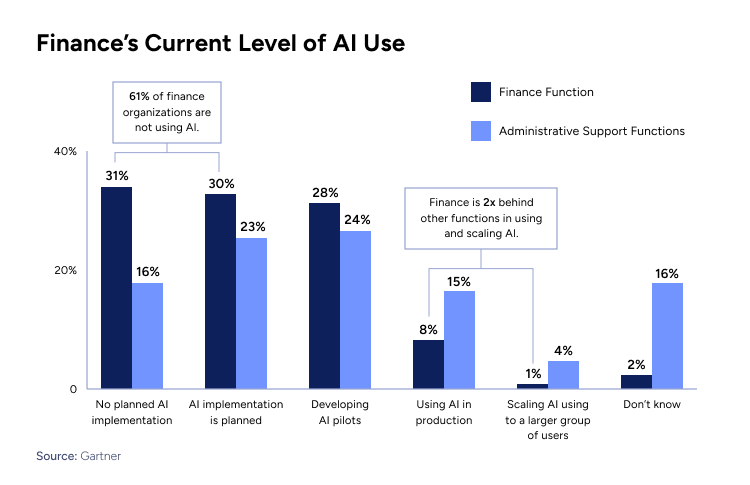

The rising adoption of digital and AI technologies is a significant driver of this market expansion. According to Gartner, only 9% of finance functions are in the scaling and using phases of AI, compared to 20% of other administrative support functions, such as HR, legal, real estate, IT, and procurement.

However, more than 80% of finance leaders expect the cost and effort required to implement AI in finance to rise over the next two years, with 52% anticipating an increase of more than 10%. This is mainly due to the disruptive potential of automation and AI, especially in accounting support, anomaly and error detection, and financial analysis.

The urgency to implement AI and automation in finance is driven by the shift in finance functions toward becoming more strategic, data-driven, and technologically driven. As underlined in the latest Consultport article on Fractional CFOs, traditional finance, which was once centered on only monitoring cash flow and financial reporting, is evolving into a more dynamic, data-oriented function, deeply integrated with the overall business strategy.

How Finance Functions Are Transforming and How Finance Consulting Can Help

Building Tech-enabled Finance Functions

Advanced Analytics and Automation

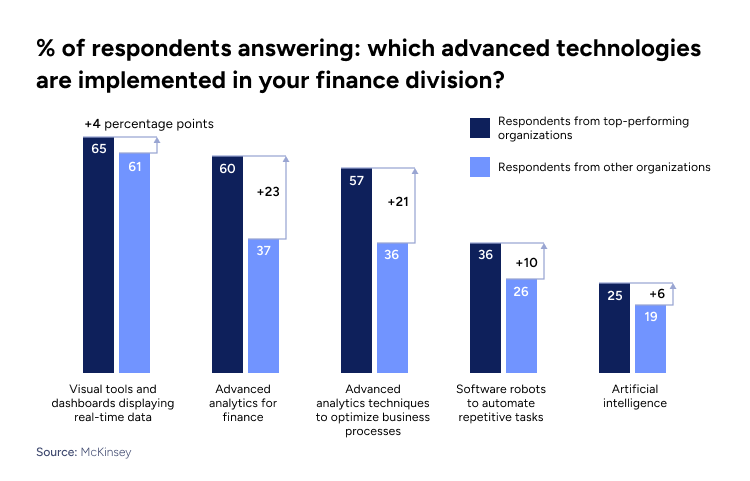

Tech-enabled finance functions are becoming a cornerstone of competitive advantage for top-performing organizations, going beyond simply visual tools and dashboards.

As highlighted by a recent McKinsey survey, 65% of CFOs from top-performing companies report using visual tools and dashboards that display real-time data, only a 4% difference from other organizations.

However, the gaps widen significantly when it comes to more advanced technologies. For example, 60% of top-performing companies use advanced analytics for finance, compared to just 37% of other organizations — a striking 23-point difference.

The gap is huge considering advanced analytics for business processes (+21%), and robotics to optimize business processes (+10%). This indicates that while many companies are catching up with basic tools, a substantial performance gap exists between the companies leveraging advanced analytics and those which are not.

Finance Consulting and Advanced Analytics

As the demand for these solutions increases, 44% of organizations anticipate skill gaps in data analytics, IT management, and digital finance over the next five years. Moreover, 57% of organizations recognize the need to build new capabilities among their workforce to handle emerging technological disruptions.

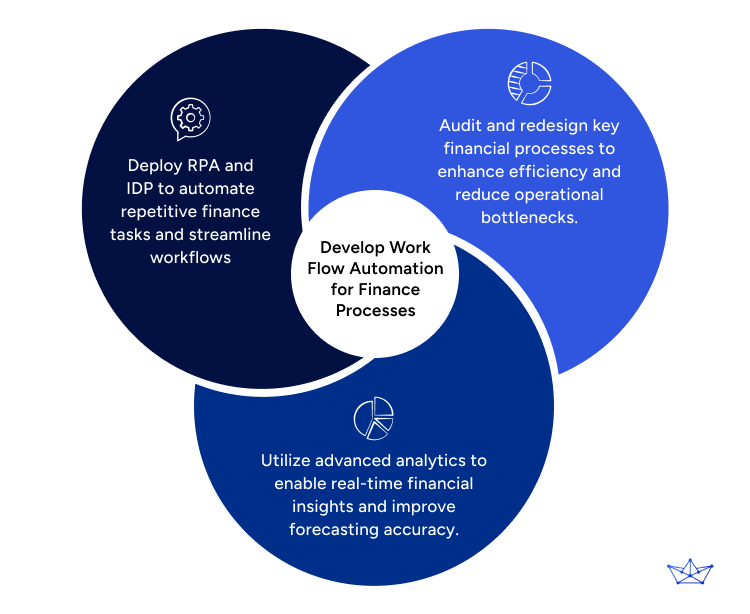

This is where Finance Consulting, and in particular Digital Finance Consultants, become essential to drive this growth. Digital finance consultants, among all, specialize in implementing advanced technologies such as Robotic Process Automation (RPA), Intelligent Document Processing (IDP), and advanced analytics within financial operations.

They work directly with the CFO, helping automate repetitive tasks, optimize data extraction and analysis, and deploy predictive analytics to enhance decision-making and efficiency. To better understand their role, let’s delve into a specific project example.

In 2023, an EdTech scale-up company engaged Consultport to address the challenge of enhancing efficiency in its finance department, specifically targeting the manual, resource-heavy Order-to-Cash (O2C) process. Consultport responded quickly, proposing three highly qualified consultants within 48 hours.

The client ultimately chose a former McKinsey consultant with a proven track record of managing over 10 large-scale automation projects, including the implementation of RPA and IDP in fast-paced, high-growth environments. The consultant's mandate was to audit existing processes, pinpoint optimization opportunities, and deploy automation solutions within the O2C process.

The project led to a 20% reduction in processing times and a decrease in manual workload, significantly improving the efficiency of the finance team. These changes help the company to scale these technologies more effectively while maintaining streamlined financial operations.

Generative AI in Finance: the “Third Wave” of Digitalization.

Current and Long-Term Applications of AI in Finance

Although strictly related to the previous one, Gen AI deserves a deeper analysis due to its enormous and disruptive potential in finance. As underlined by McKinsey, Gen AI could be defined as the “third wave” of digitalization in finance, where the first is establishing a digital foundation and the second is analytics empowerment.

According to the same report, finance functions that leverage AI in automation and Gen AI show 1.4 times higher shareholders and financial returns. This disruptive potential stems from going beyond automating tasks, by generating predictive insights and facilitating scenario planning.

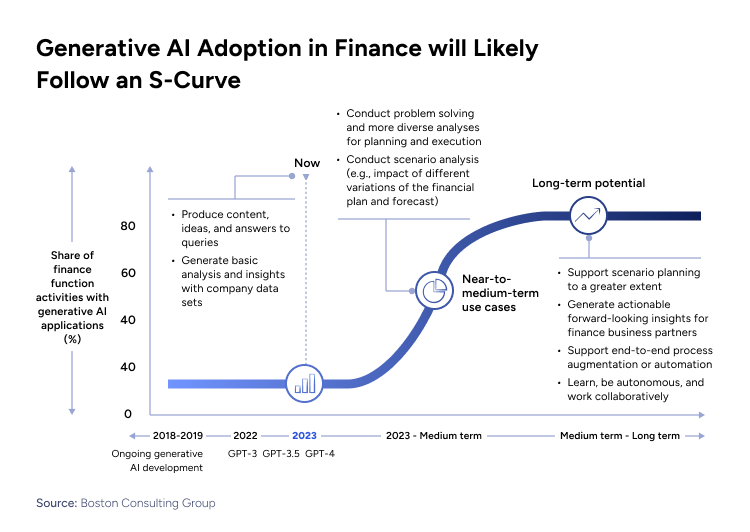

The adoption of Gen AI in finance is expected to follow an S-curve, a pattern common to technological adoption. Initially, the implementation may be slow as organizations experiment and refine their approaches. However, as the technology matures and its benefits become more evident, adoption accelerates rapidly.

Today, finance functions are in the early stages of the curve. In particular, the already mentioned RPA and IDP mostly rely on traditional AI, rather than Gen AI, but the integration of the latter is increasingly becoming relevant.

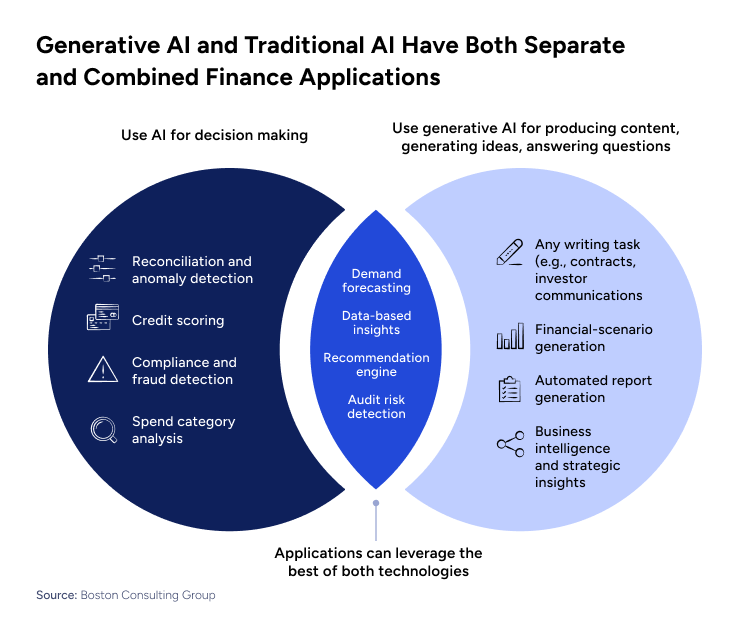

Generative AI in finance will impact core processes, such as contract drafting, invoice processing, and general-ledger reviews, increasing efficiency by approximately 10 to 20%. Gen AI and traditional AI can be seamlessly integrated to enhance use cases, such as using traditional AI for financial forecasting and Gen AI for explaining variances and offering recommendations on different scenarios and business decisions.

As AI tools are evolving, these enhancements will seamlessly be integrated within finance operations, automating a substantial portion of tasks currently handled manually. For instance, in Risk Management, Generative AI will extend its capabilities to predict and explain anomalies that could indicate fraud or noncompliance, going beyond traditional AI's current use in audits and control environments.

Finance Consulting and Generative AI

Although its integration is still in the early stages, finance consulting is increasingly specializing in Generative AI as companies recognize its potential. Consultants are crucial in guiding organizations through AI adoption, from selecting the right technologies to integrating them into existing processes.

Consultport offers highly qualified Finance Consultants and Digital Experts with deep expertise in leveraging cutting-edge technologies like Generative AI to transform finance functions. Let’s provide a concrete example.

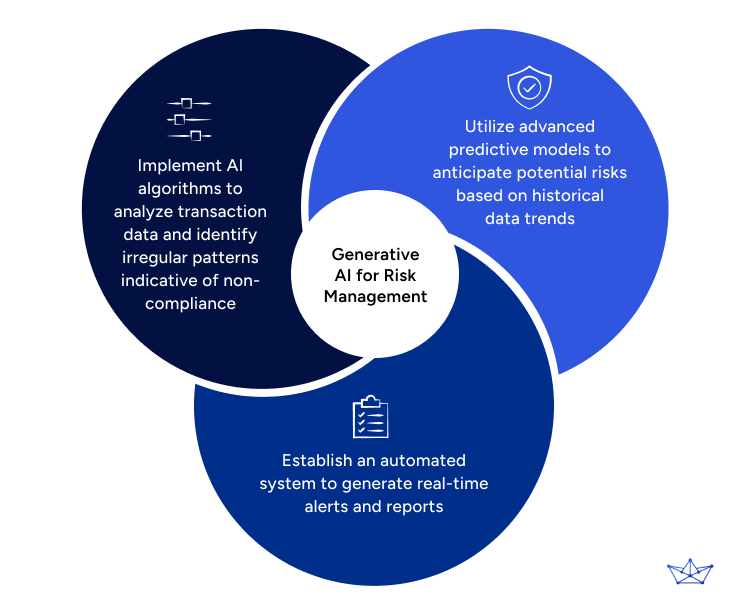

Recently, a leading Indian IT consulting firm engaged Consultport to enhance their client's risk management processes using Generative AI. The client aimed to proactively identify and mitigate risks in their finance and accounting operations through AI-driven solutions. Consultport quickly provided a shortlist of consultants, and the client selected an expert with over 7 years of experience in Management Consulting for Financial Services.

To enhance the client’s risk management, the consultant integrated various financial data sources into a centralized repository, ensuring data accuracy with WatsonX. Working directly with the finance departments, they developed custom AI algorithms using ChatGPT and WatsonX to analyze real-time transaction data, detecting irregular patterns indicative of fraud or compliance issues.

Predictive analytics models were implemented to forecast potential risks based on historical trends. An automated alert system was established, generating real-time notifications for the finance team whenever significant risks were detected. The consultant also set up a continuous learning process where the AI models refined themselves based on the finance team’s actions, improving the system’s accuracy and reliability.

The project led to a 20% improvement in risk detection speed, a 15% reduction in financial discrepancies, and an overall decrease in time required for financial reporting. The client significantly enhanced their risk management capabilities, ensuring compliance and safeguarding their financial integrity.

What Freelance Finance Consultants Can Offer

As already mentioned, companies are struggling with skills and talent gaps in AI and Automation, and freelance finance consulting is providing a suitable solution. With companies moving towards a more agile workforce, it provides a more flexible and cost-effective solution compared to traditional full-time hires.

In parallel, as more professionals leave their full-time roles, businesses are increasingly turning to freelance finance consultants to fill critical gaps. According to Morgan Stanley, freelancers are expected to make up over 50% of the US workforce by 2027. This trend offers numerous advantages:

- Specialized Expertise: Freelance finance consultants bring deep sector knowledge tailored to specific financial needs, providing high-quality, specialized advice that aligns with business goals.

- Greater Accountability: Through frequent updates and flexible billing arrangements, clients benefit from transparent, results-driven engagement.

- Efficient Communication: One-to-one communication ensures that projects are executed efficiently, allowing for quick adjustments and personalized solutions.

- Continuity and Long-term Value: Freelance finance consultants are often available for re-engagement, offering continuity as project scopes evolve.

- Access to Top Talent: Consulting Platforms, such as Consultport, facilitate matching businesses with top freelance talent, handling everything from project management to payments. Such platforms ensure companies can easily find the right experts, while freelancers focus on delivering excellent service.

Want to know more? Find a Consultant.

Nicolai is a corporate finance expert with extensive experience in investment banking, specializing in financial strategy and corporate restructuring. For his clients, Nicolai offers comprehensive support on a variety of projects, including financial restructuring, capital raising, bank and investor relationship management. Nicolai is also an experienced Mergers and Acquisitions advisor.

on a weekly basis.