3 Challenges ESG Consultants Can Help You Solve

The global ESG consulting market, valued at approximately $13.7 billion in 2023, is projected to grow to around $40 billion by 2032, with a compound annual growth rate (CAGR) of 14% from 2024 to 2032. As the importance of Environmental, Social, and Governance (ESG) factors is continuously rising, companies face more and more challenges in implementing effective ESG strategies.

These challenges include integrating comprehensive sustainability practices, aligning with new regulatory requirements, and fostering a culture of Diversity, Equity, and Inclusion (DEI). ESG consultants play a critical role in navigating these complexities by providing expertise in data management, regulatory compliance, and stakeholder engagement.

This article explores the critical role of ESG consultants in addressing various challenges, answering the following questions:

- What are the primary challenges companies face in implementing effective ESG strategies?

- How can ESG consultants assist in navigating the complexities of ESG implementation?

- How can companies develop sustainability strategies to tackle environmental challenges, going beyond traditional CSR?

- How do ESG consultants help enhance accountability and transparency in corporate reporting?

- What are the benefits and key outcomes of integrating Diversity, Equity, and Inclusion (DEI) frameworks into a company's culture?

The Growing Importance of ESG

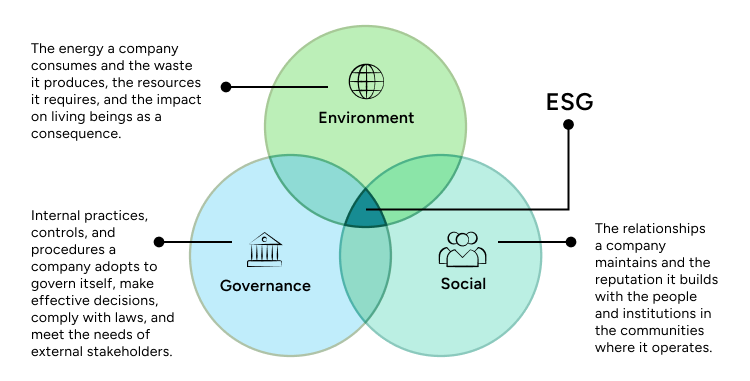

Environmental, Social, and Governance (ESG) factors are important to evaluate the sustainability and societal impact of companies and businesses. ESG criteria help investors and stakeholders assess the long-term viability and ethical impact of an organization.

Market Growth and Relevance

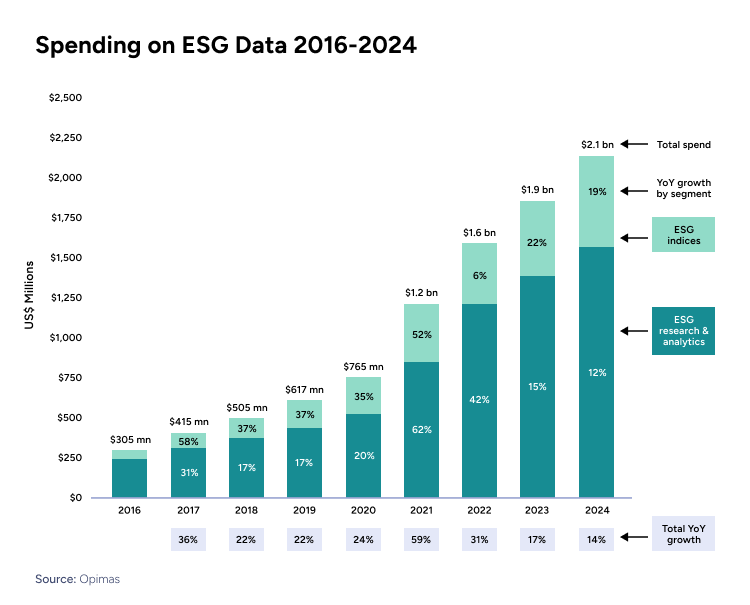

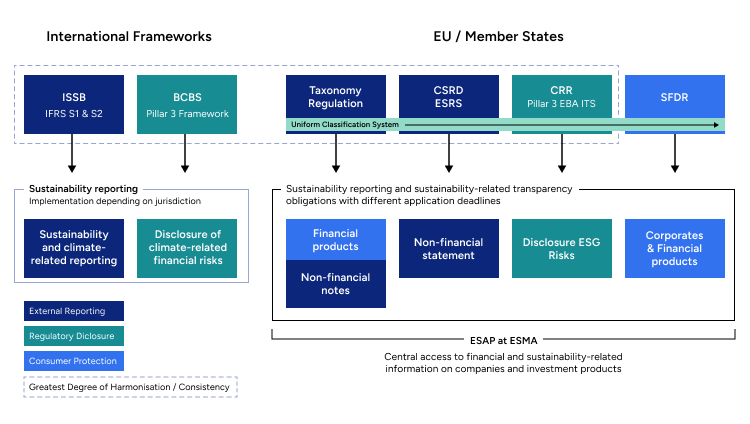

The market for ESG investments has expanded rapidly, reflecting the increasing importance of sustainability in businesses. Spending on ESG data alone is expected to exceed $2 billion in 2024, a significant rise from previous years. This growth is largely driven by regulatory requirements like the EU's Sustainable Finance Disclosure Regulation (SFDR) and the Corporate Sustainability Reporting Directive (CSRD), which mandate comprehensive ESG disclosures.

Investor interest in ESG is at an all-time high: 82% of investors believe that ESG should be an integral part of a company’s strategy. Furthermore, 66% of these investors are more confident in a company’s ESG management when a C-suite executive oversees these initiatives. This trend underscores the critical role ESG plays in shaping business strategies and maintaining investor confidence. Additionally, global ESG assets are projected to reach $50 trillion by 2025, representing over a third of the estimated $140.5 trillion in total global assets under management.

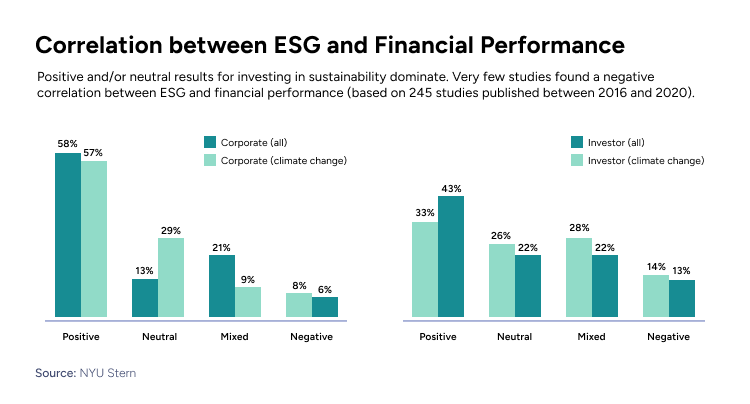

ESG and Financial Performance

Recent studies have reported a positive correlation between ESG practices and financial performance. Specifically, 58% of corporate studies focused on operational metrics such as Return on Equity (ROE), Return on Assets (ROA), or stock price found positive results. Only 8% indicated a negative relationship. In investor-focused studies, which usually look at risk-adjusted attributes such as alpha or the Sharpe ratio on a portfolio of stocks, 59% demonstrated similar or better performance compared to conventional investment approaches.

The framework distinguishes between direct correlations and mediated effects:

- Correlation: Direct relationships between ESG initiatives and financial outcomes, such as improved operational efficiency or enhanced brand reputation leading to better financial metrics.

- Mediation: Indirect pathways where ESG practices influence mediating factors like innovation, risk management, or employee satisfaction, which in turn drive financial performance.

Investor-focused studies tend to examine direct relationships, assessing how ESG performance impacts financial metrics like benchmarks and portfolio-level themes. Corporate-focused studies, on the other hand, may explore how ESG initiatives lead to financial performance through various mediating factors, providing a deeper understanding of the pathways through which sustainability initiatives contribute to corporate success.

Challenges in ESG Implementation: The Role of ESG Consultants

Despite the growing importance of ESG, companies face several challenges in its implementation. One major obstacle is the lack of comprehensive and high-quality ESG data. About 46% of investors highlight the lack of comprehensive ESG data as a significant challenge.

Regulatory compliance presents another significant challenge. Ensuring that a company’s ESG practices align with evolving regulations such as the SEC’s Climate Disclosure Rule and the EU’s CSRD is complex and resource-intensive. However, companies that successfully integrate ESG factors into their operations can achieve significant benefits, including improved risk management, enhanced reputation, and increased investor interest.

Here is where the role of ESG consultants becomes crucial. These consultants help companies navigate the complexities of ESG implementation by providing expertise in data management, regulatory compliance, and stakeholder engagement. They assist in developing tailored ESG strategies, setting measurable goals, and ensuring transparent reporting, which are essential for building trust with stakeholders and maintaining a positive market position.

There are three main types of challenges that an ESG Consultant can help solve: Environmental challenges, Social challenges, and Governance challenges.

Environmental Challenge

Moving beyond CSR: The Shared Value Approach

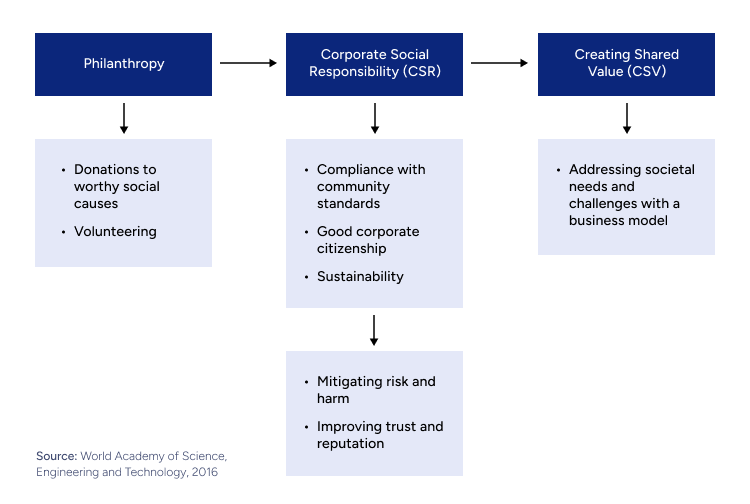

Tackling the environmental challenge through shared value goes beyond traditional Corporate Social Responsibility (CSR). In fact, it ensures embedding sustainability into the core business strategy, thus creating economic and societal benefits simultaneously.

Shared value strategies involve the integration of environmental goals with business objectives, resulting in operational practices that are both profitable and environmentally sustainable. This approach is driven by the necessity to not only comply with regulatory requirements but also to innovate and remain competitive in a rapidly evolving market.

A significant challenge in implementing shared value strategies is aligning business operations with sustainability goals while ensuring profitability. Indeed, creating shared value can enhance competitiveness by addressing societal issues that intersect with the business’s core activities.

This requires companies to rethink their products, markets, and supply chains in ways that benefit both the business and the community. For instance, global regulations such as the EU’s CSRD now mandate detailed environmental disclosures from over 50,000 companies, pushing businesses to adopt more integrated and comprehensive sustainability strategies.

The shift from CSR to shared value necessitates a systemic change in business models, incorporating advanced technologies for environmental management and fostering collaboration across sectors.

ESG Consultants bring extensive knowledge in crafting and implementing sustainability strategies, with both experience in business strategy and sustainability.

Case Study: Sustainability Strategy for a Leading Automotive Manufacturing

A leading automotive company engaged a Consultport consultant to overhaul its sustainability strategy into a comprehensive shared value approach, aligning with newly established 5-year plans and Science-Based Targets initiative (SBTi) goals for 2030 and 2050. The consultant initiated a thorough "State of Play" analysis of the company’s Scope 1, 2, and 3 emissions, revealing significant opportunities for improvement, particularly in the supply chain and product lifecycle.

Key Responsibilities:

- Manufacturing Optimization: Introducing energy-efficient technologies, retrofitting facilities, and implementing smart manufacturing processes to achieve a 15% reduction in energy consumption.

- Renewable Energy Integration: Transitioning 50% of the company’s energy needs to renewable sources through investments in solar and wind projects and signing power purchase agreements (PPAs).

- Supply Chain Sustainability: Partnering with suppliers to cut their carbon footprints by 20% via greener practices and materials, facilitated through quarterly workshops and sustainability audits.

The consultant's actions resulted in a 20% reduction in Scope 1 and 2 emissions and a 15% reduction in Scope 3 emissions within the first two years. Key performance indicators (KPIs) such as carbon intensity, energy consumption, renewable energy usage, and supplier emission reductions were closely monitored, with targets of a 25% reduction in carbon intensity and a 20% decrease in energy consumption and supplier emissions.

Community impact metrics also showed significant benefits, including local job creation. These initiatives not only ensured compliance with SBTi targets but also positioned the company as a leader in sustainability in the automotive industry, driving long-term value creation for both the business and society.

Social Challenge

Integrate DEI frameworks into the Company’s Culture

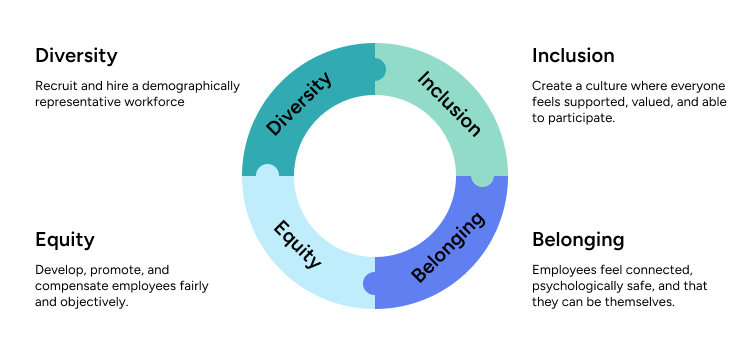

Diversity, Equity, and Inclusion (DEI) are critical components of organizational cultures. DEI focuses on creating a workplace where diverse perspectives are valued, equitable opportunities are provided, and an inclusive environment is fostered for all employees.

The importance of DEI lies in its ability to enhance innovation, improve decision-making, and foster a sense of belonging among employees. Studies from 2020 have shown that organizations with robust DEI practices are 20% more likely to outperform their peers financially and attract top talent.

Despite a widespread acknowledgment of DEI's importance, many organizations struggle to translate these principles into actionable and measurable strategies. According to the Global DEI Framework report by MSI, having a clear, communicated vision for DEI is crucial, yet many firms lack the structured approach needed to embed DEI values at every organizational level.

In particular, global DEI strategies need to be set with respect cultural nuances, which requires dedicated DEI budgets and governance structures to support implementation. Furthermore, companies must foster leadership accountability through DEI performance objectives, training, and continuous knowledge sharing to ensure that inclusive behaviors are role-modeled from the top down.

Case Study: DEI Integration for a Global Healthcare Corporation

A global healthcare corporation in the life sciences sector recently went through an organizational restructuring and encountered difficulties integrating Diversity, Equity, and Inclusion (DEI) frameworks into its company culture. The company recognized that failing to address these issues could negatively impact employee satisfaction, retention rates, and ultimately, its reputation.

To address this, the firm engaged a former Bain consultant within Consultport’s network with extensive expertise in DEI strategy and implementation across the healthcare sector. The consultant conducted a thorough audit of the company’s current DEI practices, utilizing frameworks such as the Global DEI Benchmark and the MSCI Global DEI Index. Based on these findings, the consultant developed a comprehensive DEI action plan.

The plan included the establishment of a DEI task force, regular DEI training for all employees, and the implementation of a transparent reporting mechanism for DEI metrics. Advanced HR Analytics platforms such as Visier were used to track progress and measure the impact of DEI initiatives. Key performance indicators (KPIs) such as employee engagement scores, diversity representation in leadership roles, and retention rates were closely monitored.

Key Responsibilities:

- Collaborate with Leadership Team: The consultant worked closely with senior leadership to assess the current state of DEI and define specific goals for racial and ethnic diversity initiatives.

- Strategy Development: Developed comprehensive DEI strategies that aligned with the company's organizational transformation and business objectives.

- Training and Workshops: Conducted workshops, interviews, and training sessions for the client team to build awareness and skills related to DEI.

While the consultant played a pivotal role in designing the DEI strategy, the long-term success depended on embedding DEI education into the company’s culture. The consultant left behind a robust educational framework, empowering the company's leadership to continue fostering an inclusive environment. This framework included detailed training modules, best practice guidelines, and tools for continuous learning and development. The aim was to cultivate a self-sustaining DEI culture where leaders and employees alike were equipped to champion diversity initiatives independently.

As a result, after 6 months, the company saw a 35% improvement in employee engagement scores, a 25% increase in diversity representation at the management level, and a 20% reduction in turnover rates among underrepresented groups within the first year. These significant improvements underscored the effectiveness of the tailored DEI strategy and solidified the company's commitment to fostering an inclusive workplace culture.

Governance Challenge

Enhancing Accountability and Transparency of Reporting Standards

A significant governance challenge for corporations is the need to increase accountability and transparency by aligning their ESG reporting with globally established frameworks. The shift towards comprehensive ESG governance frameworks is an evidence, with 51% of S&P 500 companies reporting multi-committee responsibility for overseeing ESG activities.

The proposed SEC rule on climate risk disclosure underscores the urgency of this alignment, as it transitions climate-related disclosures from voluntary to mandatory, impacting financial reporting. As of 2022, only 3% of S&P 500 companies did not disclose information about their overall ESG board governance approach, down from 14% in 2021 and 28% in 2020.

This trend indicates the maturation of ESG capabilities in anticipation of regulatory changes. For instance, the involvement of audit committees in overseeing climate and sustainability disclosures is growing, with 52% of companies including them in their governance frameworks.

However, the lack of an ESG reporting standard poses significant challenges to both investors and companies. This makes it difficult for companies to decide how to demonstrate their ESG credentials.

ESG consultants can help corporations navigate these complexities by providing expertise in aligning their reporting with frameworks such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD). This ensures that their disclosures meet both regulatory expectations and stakeholder demands for transparency.

Case Study: ESG Reporting for a Logistics Company

A multinational logistics services provider was struggling to meet emerging ESG disclosure requirements and faced mounting pressure from stakeholders for increased transparency. To tackle this, they engaged with Consultport, which proposed two candidates within 48 hours. The client chose a former PwC consultant with expertise in ESG governance and reporting standards.

Key Responsibilities:

- Prepare the ESG report for key stakeholders (management, investors, regulators, other stakeholders).

- Gather relevant information and data required for the ESG report.

- Work closely with diverse stakeholders within the organization and the finance team.

- Evaluate existing ESG governance frameworks and identify gaps.

- Align ESG reporting with GRI, TCFD, and SASB standards.

- Restructure the governance framework to include a dedicated ESG committee.

- Develop a plan for regular updates and training programs.

- Utilize advanced analytics tools to track and report ESG metrics.

The consultant’s main task was to prepare the ESG report for key stakeholders, including management, investors and other stakeholders. The consultant began by working closely with unit heads and the finance team to gather the relevant information and data required for the ESG report. This involved evaluating the company's existing ESG governance framework and identifying significant gaps in climate risk disclosures and overall transparency.

To address these gaps, the consultant evaluated existing practices against GRI, TCFD, and SASB standards to identify shortcomings. The consultant aligned reporting with GRI for overall sustainability, TCFD for climate-related disclosures, and SASB for industry-specific materiality. In particular, the consultant recommended restructuring the governance framework to include a dedicated ESG committee alongside the audit and risk committees, ensuring comprehensive oversight and accountability for ESG matters.

Additionally, the consultant developed a plan for regular updates and training programs to build internal capacity for ESG reporting. Advanced analytics tools, such as SASB’s Materiality Map and Bloomberg's ESG data services, were utilized to enhance data accuracy and reporting efficiency.

The consultant’s efforts led to substantial improvements: the company’s ESG rating improved by 30%, regulatory compliance risks were reduced by 40%, and stakeholder trust increased, evidenced by a 20% rise in investor satisfaction scores. These changes not only ensured regulatory alignment but also enhanced the company's reputation as a leader in sustainability within the logistics sector.

Conclusion: Why Engaging with Freelance Consultants.

The rapid growth of the ESG consulting market underscores the increasing significance of integrating Environmental, Social, and Governance factors into corporate strategies. ESG consultants play a pivotal role in helping companies navigate the complexities of ESG implementation by providing expertise in developing sustainability strategies, fostering DEI frameworks, and enhancing governance and reporting standards.

The ESG sector is experiencing a significant skills gap, with 70% of corporate leaders reporting that their organizations are under-skilled, particularly in data analysis, project management, and AI/machine learning. This shortage is further highlighted by the fact that ESG-related job roles in the financial sector offer a 20% higher salary premium compared to non-ESG roles, indicating a high demand for these skills.

Freelance consultants can bridge this gap by bringing the latest industry insights and innovative solutions, helping companies navigate the complexities of ESG implementation.

Do you want to know more? Discover Consultport’s Sustainability Consultants.

on a weekly basis.