Key Strategies for a Successful Revenue Diversification Plan

Blog Categories:

Published:

September 15, 2023

Reading Time:

7 minutes

Nowadays businesses operate in a dynamic environment interwoven with multiple factors that can shape their future. These external elements can make or break a business. They may include a slow economy, weak demand for products, and prices going up which are triggered by the COVID-19 pandemic and the Ukraine-Russia war.

In light of external uncertainties, companies are placed under huge pressure to maintain their financial stability. Revenue diversification is one of the tactics that many use to keep themselves afloat and even thrive in such a turbulent time.

Tech giants like Amazon and Google have reaped benefits from their revenue diversification strategy.

In light of external uncertainties, companies are placed under huge pressure to maintain their financial stability. Revenue diversification is one of the tactics that many use to keep themselves afloat and even thrive in such a turbulent time.

Tech giants like Amazon and Google have reaped benefits from their revenue diversification strategy.

- Amazon rose from a bookstore to a major online retail company that also works on cloud computing and digital streaming.

- Google is known for not only its search engine but translation services as well as office software.

Main streams of revenue

A Revenue Stream is known as a source of income a business has. A company can have a single or multiple sources of revenue depending on their scale, resources and strategy. Simply put, revenue diversification is about creating more streams of revenue for a business.

There are many streams of revenue and different ways to categorize them. It can be transaction-based, service-focused, or project revenue.

Let’s have a look at common types of revenue that businesses have based on the services they offer:

There are many streams of revenue and different ways to categorize them. It can be transaction-based, service-focused, or project revenue.

Let’s have a look at common types of revenue that businesses have based on the services they offer:

- Product and service sale: This is the most straightforward source of income that businesses gain from selling products and catering services to their customers.

- Advertising revenue: Media companies, websites, and social networks can earn income from displaying advertisements to their users and viewers.

- Renting or leasing revenue: A company can also make money from renting or leasing an asset they have.

- Licensing revenue: Businesses that own a copyright for a specific product earn revenues from charging a fee to an individual or organization who wants to use their content. >

- Subscription revenue: A source of income for music and video service providers comes from weekly, monthly, or annual subscriptions users pay to gain access to the music or videos.

KEY TAKEAWAYS

- Revenue diversification is a strategy used by many companies to maintain financial stability.

Top reasons why revenue diversification is necessary for your business

1. Less reliance on primary revenue

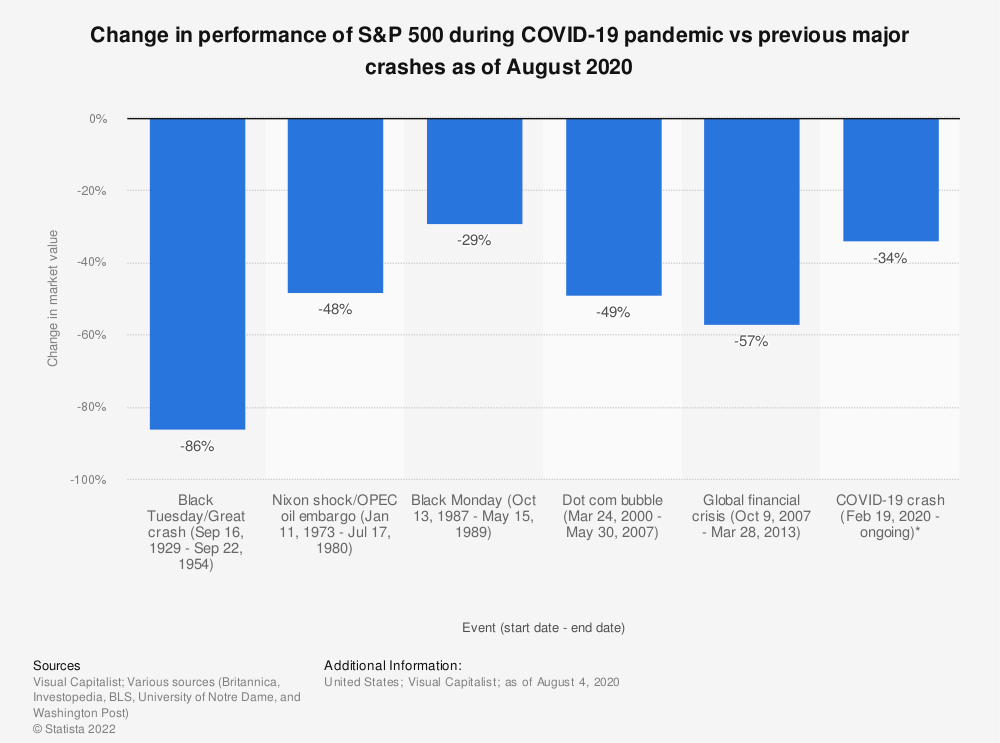

The main types of external factors are political, economic, social, technological, environmental, and legal factors (known as PESTEL). These can have both positive and negative impacts on the company’s performance.Take COVID-19 as an example. The COVID-19 pandemic was a shock to the global economy and had detrimental effects on businesses. According to data from Statista, the S&P 500 index had lost 34 percent of its value due to COVID-19 as of August 2020.

In light of external shocks, diversifying revenues can help a business better cope with the unexpected downturns of their primary revenue. They do not have to depend on a single stream of revenue and are able to maintain financial stability.

For example, when lockdown was imposed during COVID-19, ridesharing companies might struggle with falling revenues from their rideshare services. However, additional services such as food delivery, logistics, and transportation services can be massive sources of revenue for them. This helps them less depend on a single source of income and maintain financial stability.

2. Market penetration

Diversifying the streams of revenue can also help a company reach new customers and penetrate more markets.Many companies tend to sell products to niche markets only. Diversifying product ranges, if successful, can be translated to reaching more customers and penetrating new markets.

For example, a company may start as a coffee exporter and now it decides to offer not only coffee beans but also tea, cocoa, and spices. It also sells coffee makers, mugs, and bottles or offers tea and coffee tours around the farms. This strategy encourages existing coffee customers to try tea, buy mugs or join farm tours. By diversifying product and service ranges, the company can reach new customer segments and penetrate new markets like tea connoisseurs and ecotourism fans in a new demographic.

3. Mitigate risk

According to Investopedia, mitigating risk is the “primary” purpose of diversification.By expanding your product or service range, you are investing in more channels. This also means you spread the risks to more segments. In case one product goes down, you still have revenues from other products to back up.

Let’s say your company offers coffee beans, tea bags, cocoa powder as well as bartender equipment. Your investment is poured into all these segments and so is risk.

Imagine farmers have a poor crop this year and your company does not have enough coffee to sell and revenue decreases. As you still have other products and services to serve, this is not too much of a big deal for you.

Key strategies to diversify revenue streams

Revenue diversification can help companies mitigate risks, expand market reach and cope with economic downturns. So how do leaders do it? Let’s explore key strategies companies use to diversify their sources of income:

Next, you need to work on your existing sources of income and assess their performance. From the analysis, you can identify what works, what doesn’t, what has potential, and what needs improvement.

Understanding your customers and competitors is also very important to a revenue diversification strategy. You would need to use data and expertise to predict their further needs and trends as well as what’s already on offer in the market.

READ MORE: 3C Analysis Business Model In A Nutshell

There are many ways for them to create new streams of revenue and maintain financial stability. It can be launching new products/services, adding value to existing ones, or expanding your market reach. They can also consider partnering with other companies and organizations or licensing a patent and intellectual property.

Let’s take Apple as an example here. Apple started as a computer company decades ago and has risen to become one of the biggest multinational corporations in the globe. It is one of the best examples of diversification.

From a company selling desktop computers, Apple is now known for a range of products: smartphones, personal computers, tablets, wearables, and accessories. Services it provides are also varied: entertainment media and applications, mobile payment; and mobile computing.

According to Investopedia, Apple’s revenue for the products business comprised about 80.2 percent of its total revenue.

Among its products, iPhones accounted for 52.1 percent of total revenue; Macs, 10.2 percent; iPads, 7.4 percent; and Wearables, Home and Accessories, 10.5 percent. Services revenue contributed about 19.8 percent of Apple’s total revenue.

Whichever option a company chooses for revenue diversification should be based on its competencies, demand, competition, resources needed, and alignment with your mission and vision. So the key here is to do careful research before deciding on a product/service that a company wants to start with for revenue diversification.

Even when the new revenue stream works, evaluating its performance is still of crucial importance. There are many questions that businesses need to address: how each stream contributes to its business performance. Useful indicators include profitability and growth as well as the level of satisfaction of customers.

And it’s not only about the benefit element, businesses should also look at the cost. How much time, money, and human resources have you dedicated to these new streams of revenue? From this, you can keep track of the performance of the new streams and make adjustments when necessary.

It is also very important that your company reviews the value proposition on a periodic basis. This is to ensure that your proposition is still consistent and relevant to your customers.

Despite the uncertainty, many still opt to diversify for various reasons. According to a McKinsey report, more than 70 percent of large companies around the world already operate in more than two industries.

Diversification can be “an unpredictable, high-stakes game”, according to the Havard Business Review. Therefore it’s important for businesses to have professional consultancy.

Consultants will help companies identify strategic assets needed in order to succeed in the new market while ensuring that the company would catch up to or even do better than its competitors.

1. 3Cs analysis

To diversify the income sources, the first thing you need to do is identify the key skills, knowledge, and assets that make your business unique; in other words, unique selling point (USP). By focusing on these, you can further enhance your competencies and grasp more opportunities.Next, you need to work on your existing sources of income and assess their performance. From the analysis, you can identify what works, what doesn’t, what has potential, and what needs improvement.

Understanding your customers and competitors is also very important to a revenue diversification strategy. You would need to use data and expertise to predict their further needs and trends as well as what’s already on offer in the market.

READ MORE: 3C Analysis Business Model In A Nutshell

2. New revenue stream identification

After having insights into the 3Cs (Competitor, Customer, and Company), businesses need to decide which direction they want to follow.There are many ways for them to create new streams of revenue and maintain financial stability. It can be launching new products/services, adding value to existing ones, or expanding your market reach. They can also consider partnering with other companies and organizations or licensing a patent and intellectual property.

Let’s take Apple as an example here. Apple started as a computer company decades ago and has risen to become one of the biggest multinational corporations in the globe. It is one of the best examples of diversification.

From a company selling desktop computers, Apple is now known for a range of products: smartphones, personal computers, tablets, wearables, and accessories. Services it provides are also varied: entertainment media and applications, mobile payment; and mobile computing.

According to Investopedia, Apple’s revenue for the products business comprised about 80.2 percent of its total revenue.

Among its products, iPhones accounted for 52.1 percent of total revenue; Macs, 10.2 percent; iPads, 7.4 percent; and Wearables, Home and Accessories, 10.5 percent. Services revenue contributed about 19.8 percent of Apple’s total revenue.

Whichever option a company chooses for revenue diversification should be based on its competencies, demand, competition, resources needed, and alignment with your mission and vision. So the key here is to do careful research before deciding on a product/service that a company wants to start with for revenue diversification.

3. New streams of revenue evaluation

At this stage, after spending much time and resources on research and preparation, businesses are ready to launch the new revenue stream. It is important to test and validate it before pouring a huge investment into it.Even when the new revenue stream works, evaluating its performance is still of crucial importance. There are many questions that businesses need to address: how each stream contributes to its business performance. Useful indicators include profitability and growth as well as the level of satisfaction of customers.

And it’s not only about the benefit element, businesses should also look at the cost. How much time, money, and human resources have you dedicated to these new streams of revenue? From this, you can keep track of the performance of the new streams and make adjustments when necessary.

It is also very important that your company reviews the value proposition on a periodic basis. This is to ensure that your proposition is still consistent and relevant to your customers.

4. Professional consultancy

Whether diversify or not might be a daunting decision that business leaders have to make. Both benefits and risks from it can be huge.Despite the uncertainty, many still opt to diversify for various reasons. According to a McKinsey report, more than 70 percent of large companies around the world already operate in more than two industries.

Diversification can be “an unpredictable, high-stakes game”, according to the Havard Business Review. Therefore it’s important for businesses to have professional consultancy.

Consultants will help companies identify strategic assets needed in order to succeed in the new market while ensuring that the company would catch up to or even do better than its competitors.

Conclusion

Revenue diversification is a simple concept. It is basically about a business creating more sources of income. These sources can be from advertising, licensing, renting, sale of new products and services as well as subscriptions.

The strategy for revenue diversification may vary but it should start with an understanding of existing revenue streams along with insights into customers and competitors. To ensure a successful revenue diversification strategy, a company needs to very carefully identify and assess the potential sources of income before launching and pouring a significant amount of investment into them.

Despite it being a simple concept, deploying a revenue diversification strategy may seem daunting at first. A company may go through many trials and even failures before reaping its benefits.

Let our consultants help your company navigate through the challenge and ace a successful strategy for revenue diversification.

The strategy for revenue diversification may vary but it should start with an understanding of existing revenue streams along with insights into customers and competitors. To ensure a successful revenue diversification strategy, a company needs to very carefully identify and assess the potential sources of income before launching and pouring a significant amount of investment into them.

Despite it being a simple concept, deploying a revenue diversification strategy may seem daunting at first. A company may go through many trials and even failures before reaping its benefits.

Let our consultants help your company navigate through the challenge and ace a successful strategy for revenue diversification.

Share This Story, Choose Your Platform!