Trust and Value: Unleashing Power of Investor Relations

Blog Categories:

Published:

November 26, 2023

Reading Time:

7 minutes

Amid increasing globalization, rising inflation and market upheavals, investor relations has emerged as a strategic resource for companies to cope with volatile market trends.

Investor relations, simply understood as the interface between a company and its investors, has received increasing recognition and appreciation from firms. The high value of this job can be seen from the handsome pay that professionals earn.

According to an industry update report, income of investor practitioners has increased “significantly” in the last few years.

About 43 percent of senior level officers in 2022 received salary in the $276,000-$350,000 range, up from 30 percent in 2019, the report said.

So what is exactly investor relations, how does it bring value to a company and what do effective practices look like? Let’s find out in this blog post by Consultport.

Investor relations, simply understood as the interface between a company and its investors, has received increasing recognition and appreciation from firms. The high value of this job can be seen from the handsome pay that professionals earn.

According to an industry update report, income of investor practitioners has increased “significantly” in the last few years.

About 43 percent of senior level officers in 2022 received salary in the $276,000-$350,000 range, up from 30 percent in 2019, the report said.

So what is exactly investor relations, how does it bring value to a company and what do effective practices look like? Let’s find out in this blog post by Consultport.

KEY TAKEAWAYS

- Investor relations has been viewed as a strategic resource of a firm rather than a means of communication and exchange of information.

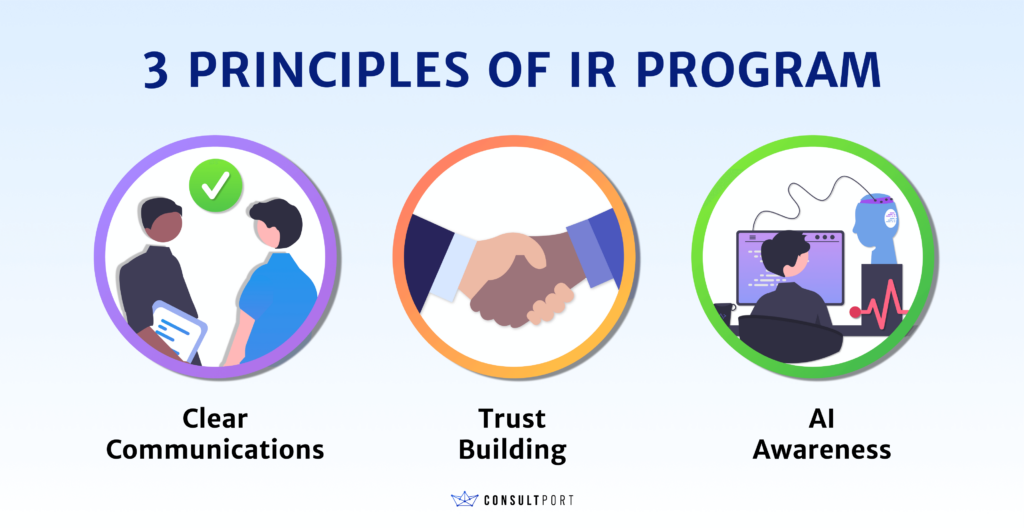

- Clear communication, trust building and AI awareness are the key principles that professionals should take into account to ensure a good investor relations program.

- A good way to assess the effectiveness of investor relations is to use a combination of qualitative and quantitative indicators.

Understanding Investor Relations

1. Definitions

There are several ways to define investor relations. Different organizations, institutes and experts have their own contribution to the understanding of this segment.The American National Investor Relations Institute, for example, defines investor relations as a “strategic management responsibility”.

It incorporates finance, communication, marketing and securities law compliance to facilitate bilateral communication between the company and financial stakeholders. Investor relations plays an important role in helping the company to maintain objective valuation of its securities, according to the institute.

Putting it in a corporate setting, one may see investor relations as a division or department of a firm. Its main tasks include providing information about the company to financial stakeholders, and maintaining the relationship between the two sides.

According to Indeed, investor relations is part of public relations. The investor relations department is common in companies that have investors and shareholders.

The role of the department, according to Indeed, is to exchange information about the operation and financial situation of the company with its shareholders, investors and members of the public. The participation of various functions: finance, marketing and communications are needed to facilitate the exchange of information.

2. Importance of investors relations

Despite various interpretations of this function, one key takeaway would be that investor relations have gone beyond mere exchange of information. It is now known as a “strategic corporate marketing strategy” and bears a significant importance in the operation of a firm.

According to a report by KPMG, investor relations has great potential in enhancing the profile of a company in the financial markets. An effective investor relations strategy can serve as a “steward of optimum value” for all stakeholders, it said.

It is quite surprising though, that investor relations is a relatively new corporate activity. It has gained more attention and become increasingly important only in the last decade.

The emergence of this as a strategy comes as there is an increasing need for disclosures of information. The provision of information from companies is crucial to assess its performance as well as forecast its future results.

3. Key roles of investor relations function

According to a report on investor relations pre and post-IPO by EY and IR magazine, investor relations has valuable contribution to a company through a range of responsibilities:- Facilitate two-way communication: it serves as the voice of the company and financial stakeholders. The function ensures the company’s management is updated with investor concerns, and these concerns are dealt with in a responsive manner. Investor relations department is also in charge of providing updates on the perception of investors about the company, and addressing misconceptions promptly.

- Manage the management: a key value that investor relations bring to a company is to “provide access to C-level executives”, according to the report. Their tasks include attracting new shareholders, and serving as a bridge between investors and company’s management, giving feedback to management.

Specifically, the investor relations team is in charge of coordinating shareholder meetings and press conferences, issuing financial data, hosting financial analyst briefings, issuing SEC filings, and dealing with the public relations of a company-specific financial crisis, according to Investopedia.

It also involves fulfilling regulatory requirements, exchanging information with investors and the market, marketing shares, and collaborating with other teams to disseminate information about shareholder expectations and how the stock market works, said Indeed.

Key Principles of an Effective Investor Relations Program

There are three main principles that a company must take into account when developing an investor relations program:

One of the measures to build trust with investors is to ensure transparency. It requires a company to be open and honest in communication and disclosure of information.

For listed companies which are obliged to provide information to the market, transparency is vital. Failure to ensure transparency can lead to regulatory action and negatively affects the company’s reputation.

According to Investopedia, investors are more likely to invest in transparent companies that provide accurate and complete information. With this transparency, investors are less likely to face “unpleasant surprises”.

In addition, transparency helps investors to make informed investment decisions and evaluate the sustainability of firms in the long term.

Transparency can be seen in a variety of ways: in regular financial reporting, clear company presentation, and timely response to investors’ inquiries. It can also involve timely and consistent updates to make sure investors are well-informed and to reduce the risk of miscalculations.

AI should be considered as a colleague assisting their job, instead of a new tool that is hard to adopt. With the capacity to process a large amount of content and various types of reports quickly, AI can potentially assist key activities in investor relations segments: - Draft communications: proxy statements, quarterly earnings reports and presentations, company background for new shareholders. - Response to investor inquiries through AI-powered chatbots. - Check shareholders’ activities through filings and fund documents.

1. Clear communication

This is a crucial requirement to build a strong relationship with investors. To this end, a firm would need: - A thorough understanding of its investor needs and preferences: this is a good start for companies to deliver relevant information. - Delivering the right messages: Once the proposition is formed, it is necessary to develop messages that showcase the company's activities, performance, strategy and long-term vision. The messages must be clear, succinct and consistent. - Good proposition: in which reasons why the company is a good fit for investors are clearly identified. A good proposition should incorporate: market and company’s growth and profitability, company’s corporate strategy and financial strength2. Trust building

Establishing trust with financial stakeholders is one of the fundamental functions of investor relations.One of the measures to build trust with investors is to ensure transparency. It requires a company to be open and honest in communication and disclosure of information.

For listed companies which are obliged to provide information to the market, transparency is vital. Failure to ensure transparency can lead to regulatory action and negatively affects the company’s reputation.

According to Investopedia, investors are more likely to invest in transparent companies that provide accurate and complete information. With this transparency, investors are less likely to face “unpleasant surprises”.

In addition, transparency helps investors to make informed investment decisions and evaluate the sustainability of firms in the long term.

Transparency can be seen in a variety of ways: in regular financial reporting, clear company presentation, and timely response to investors’ inquiries. It can also involve timely and consistent updates to make sure investors are well-informed and to reduce the risk of miscalculations.

3. AI alerts

Artificial Intelligence is changing every aspect of our life and work. While AI can be a tremendous help to investor relations professionals, they should have a good understanding of how and when to use it, according to an article about the transformative impacts of AI on investor relations by IR magazine.AI should be considered as a colleague assisting their job, instead of a new tool that is hard to adopt. With the capacity to process a large amount of content and various types of reports quickly, AI can potentially assist key activities in investor relations segments: - Draft communications: proxy statements, quarterly earnings reports and presentations, company background for new shareholders. - Response to investor inquiries through AI-powered chatbots. - Check shareholders’ activities through filings and fund documents.

Measuring IR Effectiveness

The establishment and development of an investor relations function requires significant investment and resources. As a result, it is understandable that a company would be eager to see how effective it is and whether the return on investment is worth the expenditure.However, measuring effectiveness investor relations is a big challenge due to lack of quantitative metrics.

While maximizing share price is an objective of investor relations, it would not be advisable to view share price performance alone as a key measurement.

First, it can be easily overvalued. Second, there can be a number of factors that can affect share price performance and these factors are out of control of the investor relations function.

A good way to assess the effectiveness of this function is to have a mix and combination of qualitative and quantitative indicators. They include:

- Financial indicators: share price performance, valuation ratios, variance of earnings forecasts, and share price volatility.

- Non-financial indicators: studies on analyst and investor perception, target audience contact, performance of investor roadshows, average shareholding period, quality of sell-side coverage, among many others.

From the perspective of investor relations practitioners, there are a range of elements that can affect their delivery and performance of the job. According to EY, the success of investor relations is determined by a range of critical factors.

They include:

Conclusion

Augmenting investor relations can bring great values to companies. According to Investopedia, with well functioning investor relations, companies can strengthen their access to capital markets. The good relationship with investors and analysts also helps firms acquire finance more efficiently at a lower cost.

The transparency enabled by good practice of investor relations is also crucial to enhance trust with investors and strengthen the firm’s reputation.

Moreover, a strong investor relation program also helps firms increase leverage in their investor base, attract new investors and increase the value of shares.

If you are interested in hauling the relationship with financial stakeholders, don’t hesitate to contact Consultport. Here we have a pool of talents with extensive experience and expertise who can help you reap the benefits of an effective investor relations program.

The transparency enabled by good practice of investor relations is also crucial to enhance trust with investors and strengthen the firm’s reputation.

Moreover, a strong investor relation program also helps firms increase leverage in their investor base, attract new investors and increase the value of shares.

If you are interested in hauling the relationship with financial stakeholders, don’t hesitate to contact Consultport. Here we have a pool of talents with extensive experience and expertise who can help you reap the benefits of an effective investor relations program.

Share This Story, Choose Your Platform!