5 Major Types of Due Diligence Explained (With Checklists)

Blog Categories:

Published:

December 7, 2023

Reading Time:

6 minutes

Have you ever thought about the process that precedes significant business decisions like mergers, acquisitions, or investments? You see, acquisitions or investments are like choosing a partner for marriage—you need to know all the necessary details beforehand.

This is where due diligence comes into play. For business decisions, it serves as a thorough investigative journey encompassing financial scrutiny, legal assessments, and operational evaluations. The aim is to ensure informed and strategic decision-making in the corporate realm.

In this article, we will discuss the five important types of due diligence and include a checklist for you in each section. Feel free to use the checklist next time you’re considering due diligence.

So, let’s dive into it.

This is where due diligence comes into play. For business decisions, it serves as a thorough investigative journey encompassing financial scrutiny, legal assessments, and operational evaluations. The aim is to ensure informed and strategic decision-making in the corporate realm.

In this article, we will discuss the five important types of due diligence and include a checklist for you in each section. Feel free to use the checklist next time you’re considering due diligence.

So, let’s dive into it.

KEY TAKEAWAYS

- Due diligence is a process conducted before significant business decisions, such as mergers, acquisitions, or investments, to assess potential risks and opportunities.

- Some types of due diligence include financial, legal, strategic, operational, and environmental due diligence.

- Areas of investigation during due diligence may include financial stability, legal compliance, human resources practices, operational efficiency, and strategic alignment.

- Freelance mergers and acquisitions (M&A) consultants can be hired by companies to conduct due diligence effectively.

What Is Due Diligence?

Let’s assume that you’re hungry and so you go out to eat. You find the nearest fast food joint, have a burger meal, and come back home—easy and simple. Now, let’s assume that you want to buy a brand-new car. In this case, the stakes are higher and mistakes can be costly. To make the right decision, you must go through various options, visit multiple dealerships, ask friends and family, read online reviews, and investigate as much as possible. That’s due diligence in a nutshell.

Now, from a company perspective, due diligence serves as a comprehensive investigative process conducted before making significant decisions such as mergers, acquisitions, or investments. To be precise, it involves an in-depth examination that requires assessing various aspects of a business or venture to ensure that decision-makers have a clear understanding of potential risks and opportunities.

So, here are certain aspects that are assessed during the due diligence process:

By scrutinizing financial records, stakeholders can identify potential risks and make sound financial decisions. For instance, during an acquisition, understanding the financial health of the target company helps in negotiating a fair deal and ensures a smoother integration process. This ensures that the buyer pays a fair price and the acquiree company gets the right price.

For example, a thorough legal due diligence process can help a company avoid post-acquisition legal complications. This enables a smoother transition and minimizes the chances of unforeseen legal challenges. You see, you would want to find out if a company that you’re dealing with is involved in illegal activities like money laundering, worker exploitation, fraud, or anything sinister.

Let’s take Microsoft's acquisition of LinkedIn for $26.2 billion as an example, which was very strategic. Microsoft didn't just focus on the immediate financial gains by acquiring LinkedIn. Instead, they considered how LinkedIn's offerings aligned with Microsoft's long-term strategy. The tech giant assessed LinkedIn’s market positioning in the professional networking sphere and its growth potential in the evolving tech landscape. You see, Microsoft offers a range of digital products to professionals such as Microsoft 365, OneDrive, Microsoft Teams, and many more. Hence, by acquiring LinkedIn, Microsoft gained access to millions of its potential customers—now that’s a great strategy!

For example, let’s suppose a retail company wants to acquire a smaller chain. Operational due diligence could include analyzing the smaller chain's inventory management, staffing, and customer service processes. If the assessment reveals inefficiencies, optimizing this post-acquisition could help streamline operations and reduce costs.

That’s why environmental due diligence is key in this day and age. It’s a critical assessment of a company's environmental practices, potential liabilities, and adherence to sustainability standards. This type of due diligence has gained prominence as businesses increasingly recognize the importance of environmental responsibility.

So, when considering a business investment or partnership, understanding a company's environmental impact is crucial. Environmental due diligence involves evaluating factors such as waste management, pollution control, and compliance with environmental regulations. Uncovering any environmental risks not only protects you from potential legal issues but also aligns with the growing global focus on sustainable business practices. This type of due diligence contributes to responsible decision-making and strengthens your commitment to environmental stewardship in the business world.

Now, from a company perspective, due diligence serves as a comprehensive investigative process conducted before making significant decisions such as mergers, acquisitions, or investments. To be precise, it involves an in-depth examination that requires assessing various aspects of a business or venture to ensure that decision-makers have a clear understanding of potential risks and opportunities.

So, here are certain aspects that are assessed during the due diligence process:

- Financial records: Examination of financial statements, profit and loss reports, and balance sheets to assess the economic health of a business.

- Employee and human resources: Review of employee contracts, benefits, and the overall human resources landscape to understand the workforce side of things.

- Legal agreements: Scrutiny of contracts, licenses, and legal agreements to detect any potential legal risks and ensure compliance.

- Regulatory compliance: Verification of a business's adherence to industry regulations and legal requirements to mitigate regulatory risks.

- Operations: Evaluation of day-to-day operations to identify strengths, weaknesses, and areas for improvement in efficiency and effectiveness.

5 Types of Due Diligence

Now that you know what due diligence entails on a surface level, it’s time to dive a little deeper. So, let's discuss the five different types of due diligence that are commonly used. This is not an exhaustive list, however. There are some other types too that we can discuss in another post. For now, let’s start with discussing financial due diligence and take it from there.1. Financial due diligence

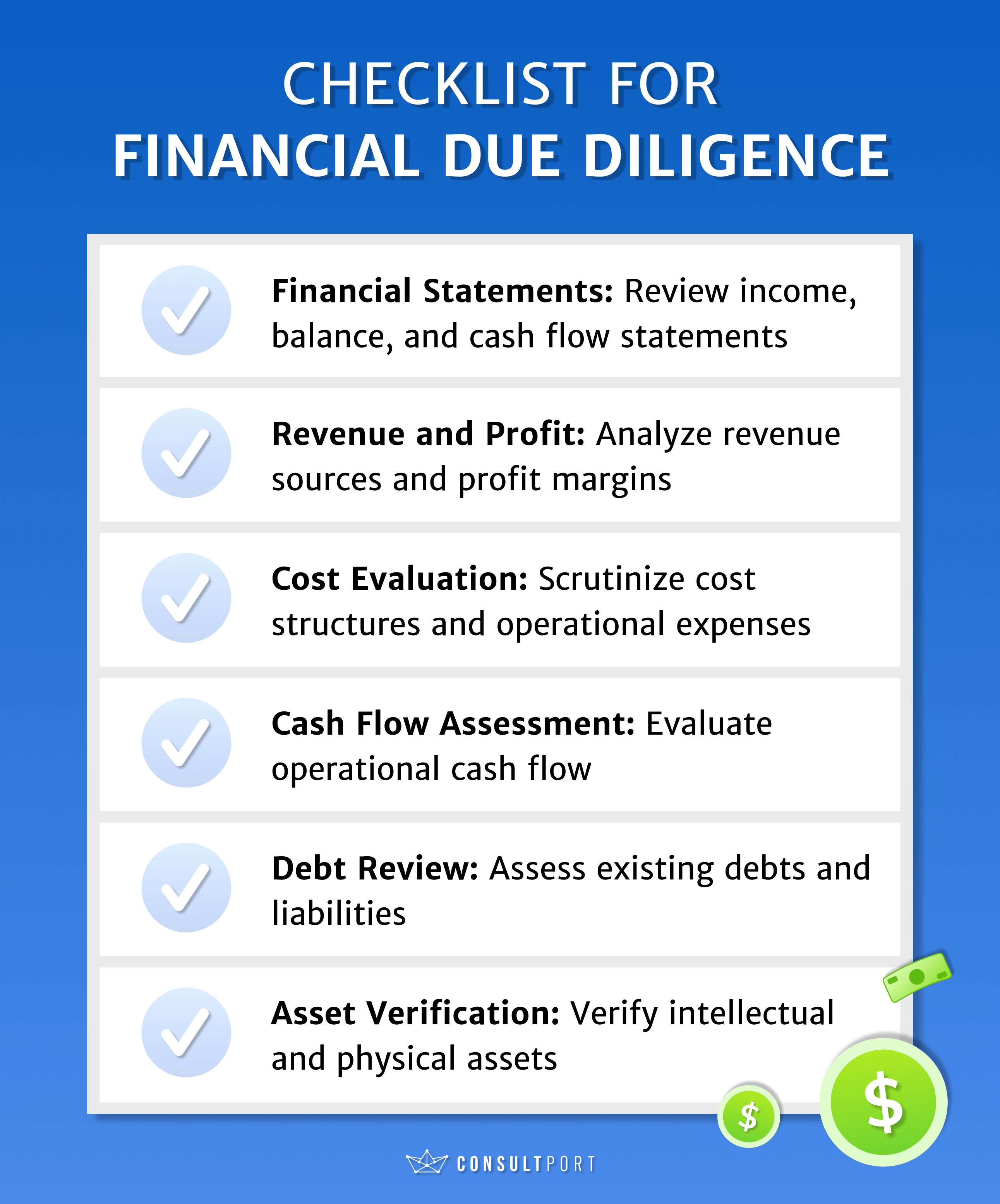

When it’s a business, money comes first. That’s why assessing the financial side of things is a top priority. Financial due diligence involves a thorough examination of a company's financial aspects. This is when a company’s historical performance, cash flow, and assets and liabilities are looked at with a magnifying lens. This process is crucial for potential investors or buyers as it provides a clear picture of the target company's economic viability.By scrutinizing financial records, stakeholders can identify potential risks and make sound financial decisions. For instance, during an acquisition, understanding the financial health of the target company helps in negotiating a fair deal and ensures a smoother integration process. This ensures that the buyer pays a fair price and the acquiree company gets the right price.

CHECKLIST FOR FINANCIAL DUE DILIGENCE

2. Legal due diligence

It’s risky to acquire a company that has ongoing legal disputes. Therefore, legal due diligence is focused on assessing the legal aspects of a business, such as contracts, licenses, litigation history, and regulatory compliance. It ensures that the entity adheres to legal requirements and uncovers any potential legal risks that might impact the decision-making process.For example, a thorough legal due diligence process can help a company avoid post-acquisition legal complications. This enables a smoother transition and minimizes the chances of unforeseen legal challenges. You see, you would want to find out if a company that you’re dealing with is involved in illegal activities like money laundering, worker exploitation, fraud, or anything sinister.

CHECKLIST FOR LEGAL DUE DILIGENCE

3. Strategic due diligence

Company owners rarely sell or acquire other companies without a strategic mindset. This means that if a company is being acquired and merged with another one, there must be a strategic reason behind it. This is when strategic due diligence comes into play. It assesses the alignment between a business opportunity and broader strategic goals. By delving deep into market positioning and growth potential, this due diligence type provides decision-makers with a holistic view of strategic implications.Let’s take Microsoft's acquisition of LinkedIn for $26.2 billion as an example, which was very strategic. Microsoft didn't just focus on the immediate financial gains by acquiring LinkedIn. Instead, they considered how LinkedIn's offerings aligned with Microsoft's long-term strategy. The tech giant assessed LinkedIn’s market positioning in the professional networking sphere and its growth potential in the evolving tech landscape. You see, Microsoft offers a range of digital products to professionals such as Microsoft 365, OneDrive, Microsoft Teams, and many more. Hence, by acquiring LinkedIn, Microsoft gained access to millions of its potential customers—now that’s a great strategy!

CHECKLIST FOR STRATEGIC DUE DILIGENCE

4. Operational due diligence

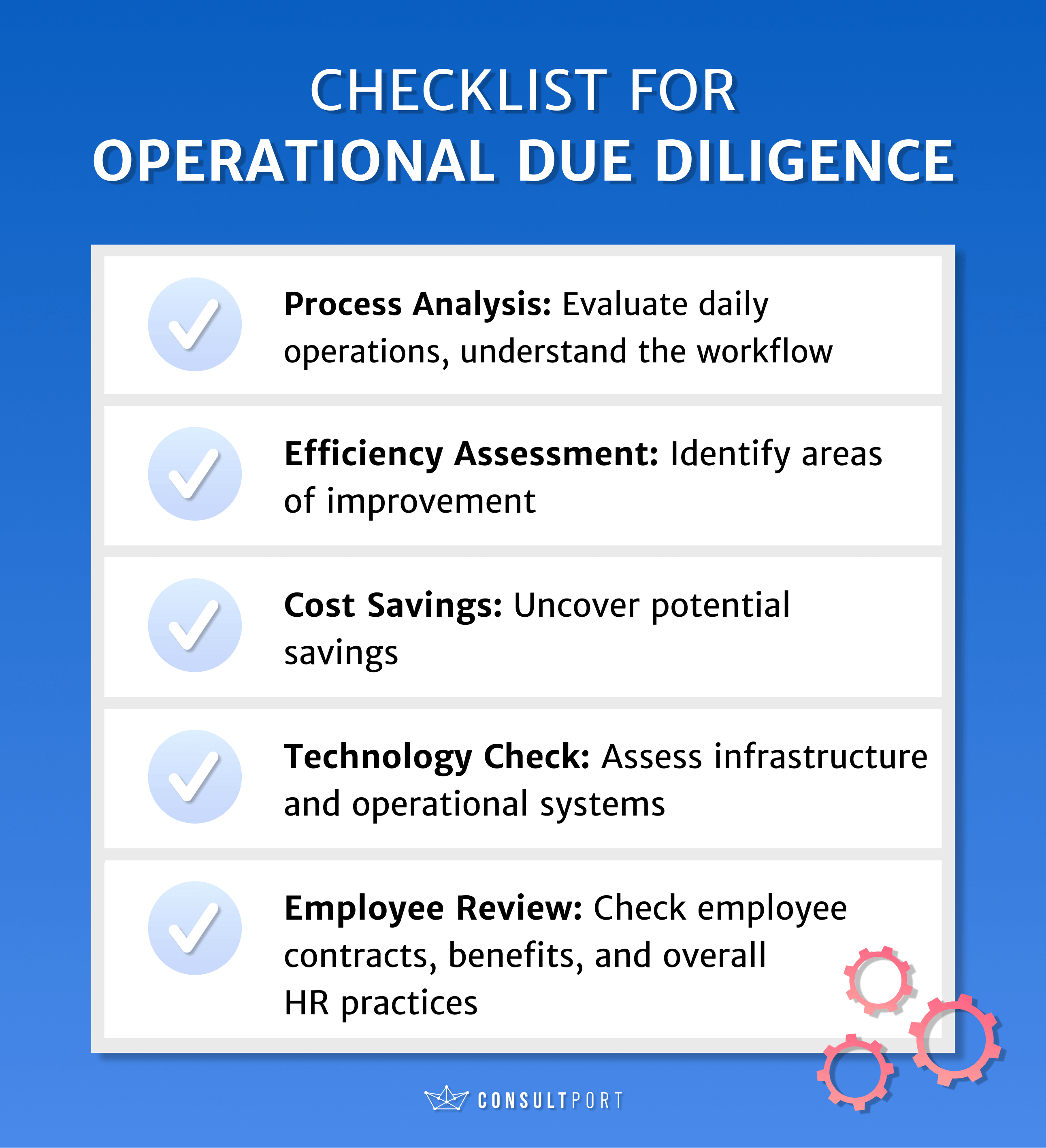

Before merging a new business with an existing one, company owners often observe daily operations first. A comprehensive assessment that centers on the day-to-day operations of a business is called operational due diligence. It strives to identify areas for improvement, assess overall efficiency, and uncover potential cost-saving measures. By conducting operational due diligence, businesses can address inefficiencies and enhance profitability as well as operational excellence.For example, let’s suppose a retail company wants to acquire a smaller chain. Operational due diligence could include analyzing the smaller chain's inventory management, staffing, and customer service processes. If the assessment reveals inefficiencies, optimizing this post-acquisition could help streamline operations and reduce costs.

CHECKLIST FOR OPERATIONAL DUE DILIGENCE

5. Environmental due diligence

Oh, the environment. This is a topic that has gained momentum in recent years. For instance, the European Union is taking legal steps to turn their economy carbon neutral by 2050. Many other jurisdictions around the world are taking similar steps. In short, companies have to be environment-friendly now.That’s why environmental due diligence is key in this day and age. It’s a critical assessment of a company's environmental practices, potential liabilities, and adherence to sustainability standards. This type of due diligence has gained prominence as businesses increasingly recognize the importance of environmental responsibility.

So, when considering a business investment or partnership, understanding a company's environmental impact is crucial. Environmental due diligence involves evaluating factors such as waste management, pollution control, and compliance with environmental regulations. Uncovering any environmental risks not only protects you from potential legal issues but also aligns with the growing global focus on sustainable business practices. This type of due diligence contributes to responsible decision-making and strengthens your commitment to environmental stewardship in the business world.

CHECKLIST FOR ENVIRONMENTAL DUE DILIGENCE

How Consultport Can Help

Mergers and acquisitions can be really stressful, and if mistakes are made, they can be costly, too. But don’t worry because there are experts who have helped hundreds of companies complete successful M&A projects. We’re talking about merger and acquisition consultants.

Here at Consultport, we have over 10,000 consultants from different areas of expertise in our talent pool. All our pre-vetted consultants have worked with top consulting firms or blue-chip companies. So, you get only the best of the best. Here’s what our highly experienced M&A consultants can do for you:

If that sounds interesting to you, get in touch now. Your next M&A superstar could just be a few emails away.

Here at Consultport, we have over 10,000 consultants from different areas of expertise in our talent pool. All our pre-vetted consultants have worked with top consulting firms or blue-chip companies. So, you get only the best of the best. Here’s what our highly experienced M&A consultants can do for you:

- Target identification: Dive into diagnostics and benchmarks to pinpoint the ideal company for your business. Let's find that perfect match for your next big move!

- M&A strategy: Let's sit down and define the mission and objectives of your M&A activities. It's not just a strategy—it's your roadmap to success in the business world.

- Equity story and exit value: Let us craft the perfect story to showcase your company's unique selling points. You see, it's not just about numbers, it's about making your business shine for investors and boosting that valuation!

- Debt and equity financing: Together, we'll figure out the optimal financing structure for your M&A activities.

If that sounds interesting to you, get in touch now. Your next M&A superstar could just be a few emails away.

Share This Story, Choose Your Platform!