Remember to fill in all the fields

Private Equity Outlook 2025

Join thousands of professionals using this resource

Join thousands of professionals using this resource

- Executive Summary

- Private Equity 2023 Recap & 2024 Outlook

- Strategic Considerations

Despite an underperforming year, the outlook for 2024 is cautiously optimistic. With interest rates expected to stabilize, economic recovery on the horizon, and PE firms holding record levels of dry powder reserves, the stars are aligned for deal-making activities to return to normal. On the other hand, after postponing exit activities in 2023, PE firms are under pressure to distribute capital back to its investors, creating more urgency for them to actively seek exit opportunities in 2024. The lack of return will also make investors more selective when putting money into new funds, making fundraising more challenging. To navigate the aftermath of a difficult year, PE firms should make long-term value creation their top priority.

In addition, to prevent undesirable exist or insufficient capital, PE firms should explore Net Asset Value (NAV) financing and other alternatives to secure asset returns. They could also employ innovative exit strategies to overcome the valuation gap caused by market volatility. Options like continuation funds, performance-based earn-outs, and corporate carve-outs can offer viable paths to liquidity. Finally, technologies such as generative AI can play a pivotal role in enhancing deal analysis, optimizing operational efficiency in portfolio companies, and ensuring smoother post-acquisition integration. Amid economic uncertainties and cautious investor sentiment, this multi-faceted approach will be vital for PE firms to thrive in 2024.

Our guides and templates are built to be practical, flexible, and easy to implement. Each resource includes real-world frameworks, best practices, and use cases that you can apply immediately.

Tailored for fast-moving project teams and decision-makers, these guides help you structure and lead initiatives with clarity and confidence.

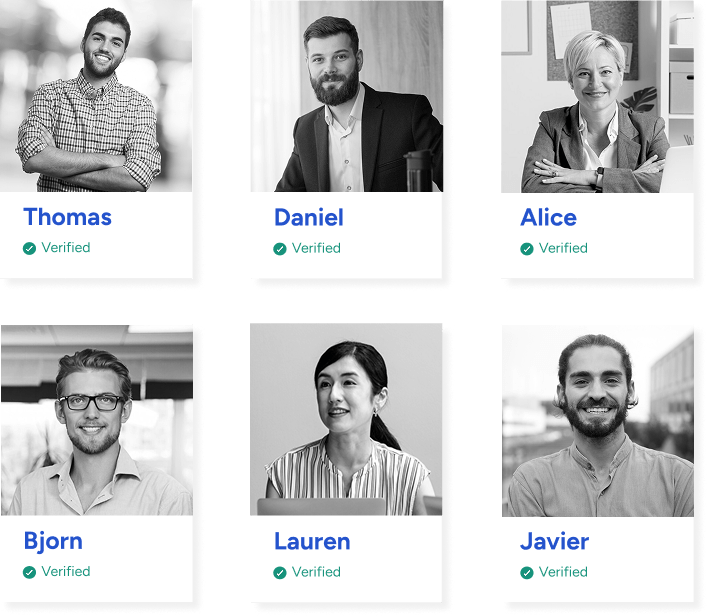

Top-Tier Consultants

These resources are inspired from seasoned freelance consultants from the Consultport network.

Designed to help internal teams and freelance experts work seamlessly together, our tools bring top-tier consulting standards to your business, without starting from scratch.