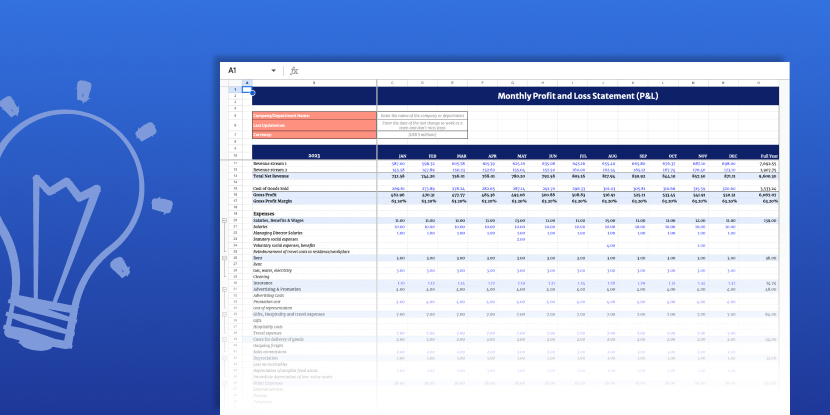

Remember to fill in all the fields

Profit and Loss Statement Template

Join thousands of professionals using this resource

Join thousands of professionals using this resource

- Identify areas for improvement and make informed decisions.

- Present your Financial Situation to Stakeholders.

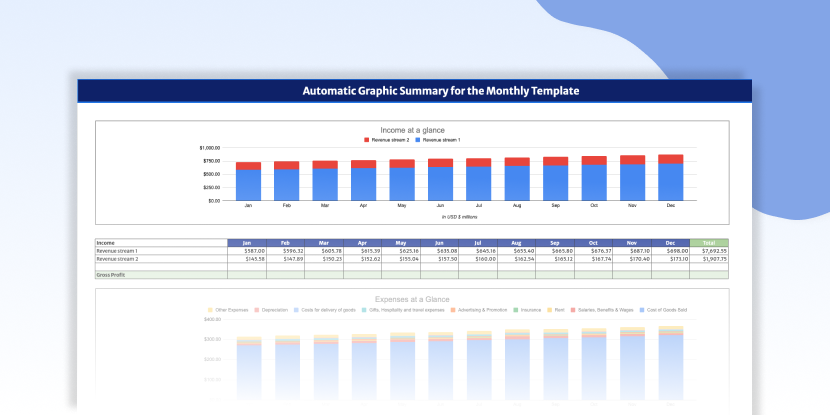

- Use automatic charts for a highly communicative presentation.

Stand out and make a difference in the new ultra-competitive markets with this free template.

The profit and loss statement, (or income statement), is a financial tool that provides company’s revenues, expenses, and net income for a specific period.

This information can help businesses evaluate their financial health, make informed decisions, and plan for the future. Today, companies of all sizes and industries use profit and loss statements as a critical component of their financial management strategy.

To optimize the usefulness of this tool, businesses should ensure they have accurate and timely data, use comparative analysis, and regularly review their results. In conclusion, a profit and loss statement is essential for any business looking to manage its finances effectively and make informed decisions.

Our guides and templates are built to be practical, flexible, and easy to implement. Each resource includes real-world frameworks, best practices, and use cases that you can apply immediately.

Tailored for fast-moving project teams and decision-makers, these guides help you structure and lead initiatives with clarity and confidence.

Top-Tier Consultants

These resources are inspired from seasoned freelance consultants from the Consultport network.

Designed to help internal teams and freelance experts work seamlessly together, our tools bring top-tier consulting standards to your business, without starting from scratch.