Well done, everything is ready to sail!

You can access your Private Equity Value Creation Guide at any time

Back to Resource Page

Why Consultport’s PE Value Creation Guide?

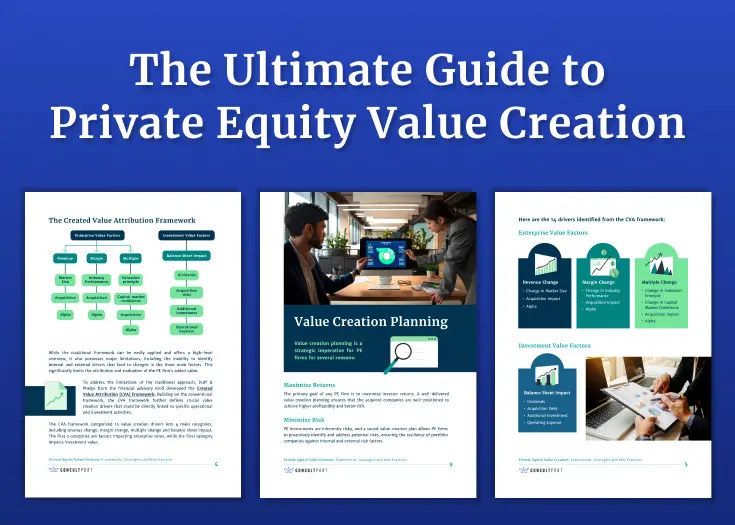

For Private Equity (PE) firms, value creation is about realizing the intrinsic value of an investment through growth opportunities and leveraging capabilities of their portfolio companies.

The clock starts ticking for everyone to deliver value as soon as a company is added to the portfolio. Thus, a meticulous planning process and a comprehensive value creation plan is crucial for PE firms to ensure that their investments would reach their full potential by the end of the deal cycle. A robust planning procedure also enables PE partners to identify potential threats and actively mitigate them.

Presented by Consultport, this practical guide offers structured frameworks, crucial levers and impactful strategies for value creation. We’ve also included a 5-step guide and a hands-on template for you to create a comprehensive value creation plan. Finally, we offer 3 best practices to maximize your value creation efforts.